How Installment Loans Work: Repayment Schedules, Monthly Payments, and Real-World Examples

An installment loan is a borrowing option that provides funds upfront and allows you to repay the balance over time through scheduled payments. This guide explains how installment loans work, including how repayment is structured and how it differs from lump-sum loans. We’ll also go over some key steps you should take before borrowing.

Key takeaways:

- Installment loan payments are generally for a fixed amount if the interest rate is fixed; variable interest rates cause your monthly payment amounts to change when interest rates go up or down.

- Net Pay Advance installment loan interest rate is fixed.

- The percentage of principal versus interest on each monthly installment payment is broken down on an amortization schedule in your loan agreement.

- Several factors make installment loans appealing to borrowers, including predictable payments, budget alignment, and reduced repayment pressure.

Breaking a loan balance up into installment payments makes it more manageable for the borrower. A common example of this is an auto loan. According to Kelley Blue Book, the average price of a new car in the United States rose to over $50,000 in 2025. Most Americans can’t afford that as one lump sum payment. Installment loans, like an auto loan, make the purchase possible.

Introduction to Installment Loans

Installment loans are one of the most common forms of borrowing in the United States, but they come in several different forms. When researching borrowing options, review the loan repayment structures to ensure they’re affordable. To avoid default, it’s essential to understand your options before signing the loan agreement.

What Is an Installment Loan?

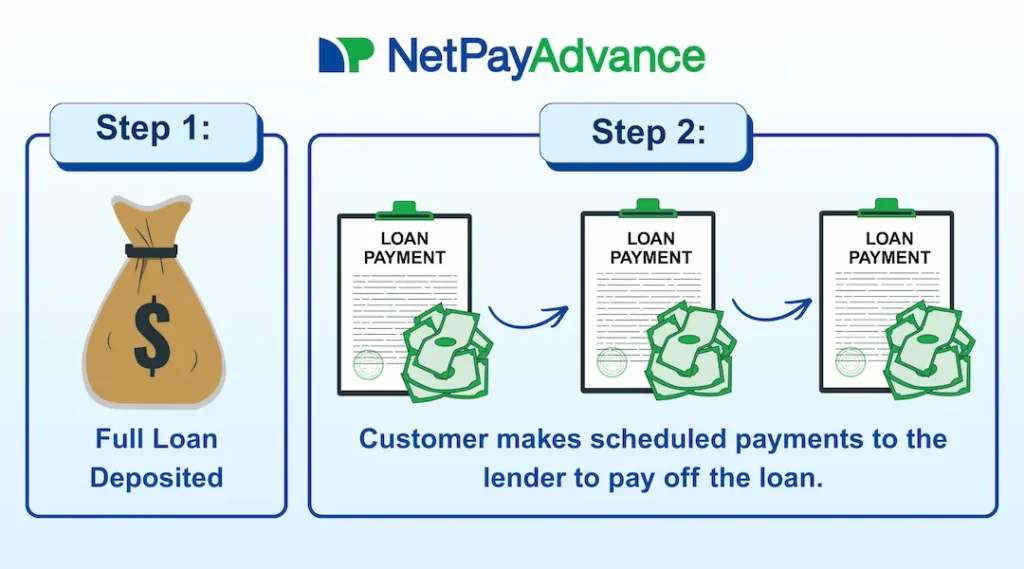

“Installment” is the key descriptor in this type of borrowing agreement. An installment loan is a lump sum disbursement that you agree to repay in installments over a specific term, usually measured in months. Examples of this include six-month and twelve-month terms for short-term loans and terms as long as 360 months for mortgages, which are also installment loans.

Each payment covers a portion of the principal (the amount borrowed) plus interest. The payments will be for a fixed amount if the interest rate is fixed, but a variable interest rate could cause your payment amounts to change if economic conditions change. For instance, if the Federal Reserve raises the federal funds rate, your lender will likely raise their interest rate.

Purpose of Installment Loans

The most obvious use for an installment loan is to make a large purchase more affordable. Common examples of this are car repairs, home improvements, and medical bills. Each of these is an expense that is not usually affordable as a lump sum payment. Many of them are also emergency expenses that need to be addressed immediately.

What Is a Net Pay Advance Installment Loan?

Net Pay Advance offers installment loans in select states. They are six-month short-term personal loans made to help cover emergency expenses. They are a fixed rate and fixed fee installment loan, making the payments predictable. Skip to read more about how Net Pay Advance installment loans work.

How Installment Loan Repayment Works

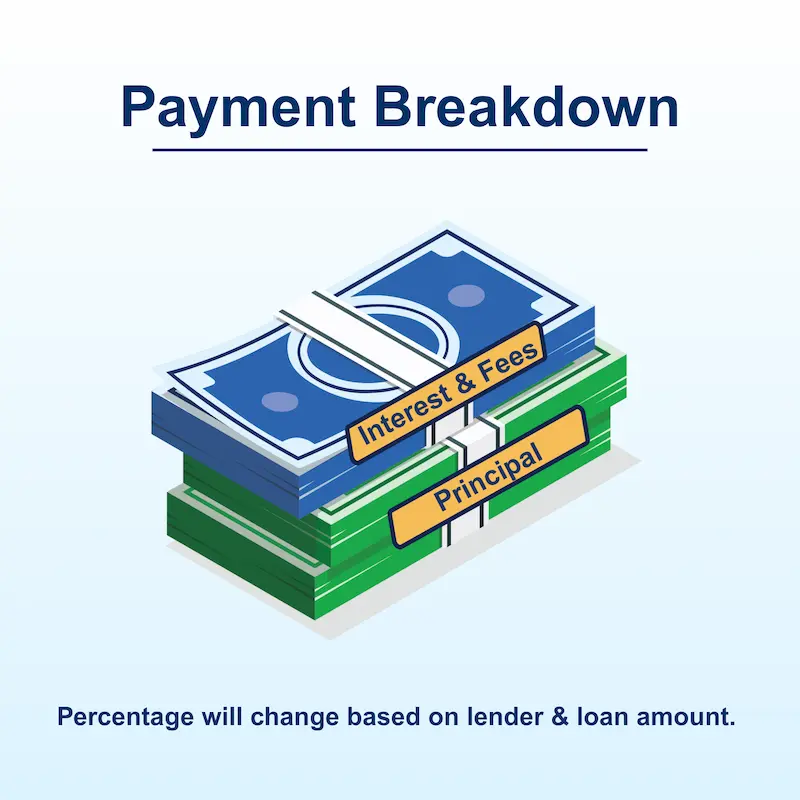

Understanding how repayment works is essential before taking out any loan. With installment loans, the repayment process is designed to be predictable and manageable. There are three components: principal, interest, and fees. Each of these represents a percentage of your monthly payment. The breakdown is laid out in your loan agreement.

Repayment Structure

Repaying a loan in installment payments is a simple concept that makes budgeting easier. With fixed-rate loans, your payments will be a fixed amount every payment period. Variable-rate loans will have different payment amounts when interest rates change, but the principal and fees typically remain the same, provided you make your payments on time.

The percentage of principal versus interest on each payment is broken down with an amortization schedule. If you took out a mortgage to buy your house, you can see how this works for a long-term loan. Short-term loans and payday loans may distribute the interest portion equally across the term. There may also be fees for repaying your loan early.

How Installment Loan Payments Are Calculated

The principal of an installment loan is split into monthly payments based on the loan term, which is the number of months you’ll have to repay the loan. A percentage of the total interest owed on the loan will also be included in each monthly payment, along with monthly fees if there are any. These variables all factor into calculating equal installment payments.

The exact composition of the payment will change based on the lender, loan amount, and where you’re at in repayment. Scheduled payments will always be some combination of these things.

Most lenders charge more interest in the early months of the loan, with payments at the end of the loan term going primarily towards the principal. Keep this in mind if you’re given a choice of loan terms. Long-term loans look appealing because the payments are lower, but you’ll likely end up paying more total interest than you would with a short-term loan.

Tip: Net Pay Advance customers save on interest and fees when they pay off an installment loan in two weeks, rather than six months. Paying off early to save on interest and fees is common for most installment loan lenders. Skip to read more about how Net Pay Advance installment loans work.

Installment Loan Examples: Repayment Scenarios

These examples demonstrate how installment loans provide consistent payments and a clear repayment timeline, allowing borrowers to plan their budgets accordingly. Consider these scenarios as examples of how installment loan repayment works:

Example #1: A borrower takes out $500 over 3 months. They’re scheduled to make two payments a month. Instead of repaying the full amount plus interest in one payment, the borrower makes six separate payments, minimizing the total interest they will pay on the installment loan. Each payment covers a portion of the $500 principal plus applicable interest charges and monthly fees.

Example #2: A borrower takes out $500 over 6 months.They’re scheduled to make two payments a month. The longer term means smaller individual payments compared to a shorter repayment window, but the total interest paid ends up being higher, making the loan more expensive. The borrower knows exactly how much is due each month and has a clear timeline for when the loan will be fully repaid.

Installment Loans vs Payday Loans: Repayment Comparison

The primary difference between installment loans and payday loans is the payment period. While installment loan payments are spread over several months, payday loan repayment is often due at the next pay period. Understanding the differences in repayment structure can help clarify how the loans function.

How Payday Loan Repayment Works

Payday loans typically require one lump-sum repayment, meaning you must pay back the entire borrowed amount plus fees in a single payment. The repayment window is usually short, often due on your next payday, which may be just two weeks away.

How Installment Loan Repayment Differs

In contrast, installment loans spread payments over time across multiple pay periods. This creates a predictable schedule where you know exactly what is due and when. This simplifies

budgeting and cash flow management, but it extends the debt for a longer period. Those two factors should be weighed carefully before signing the final loan agreement.

Why Some Borrowers Prefer Installment Loans

Several factors make installment loans appealing to borrowers, including predictable payments, budget alignment, and reduced repayment pressure. In other words, knowing what you owe and when it’s due makes it simpler to plan for. Some lenders also offer that provide additional flexibility for borrowers in certain states.

Lenders want to offer loan amounts that are realistic to pay off. Because of this, payday loan amounts tend to be smaller than installment loans. Payday loans are expected to be able to be repaid within 8-30 days. Installment loans are expected to be repaid over several months.

When an Installment Loan May Make Sense

Unexpected medical bills, urgent car repairs, or necessary home maintenance are three very common reasons to apply for an installment loan. Buying a new car or home might not seem as urgent, but those actions are sometimes necessary to ensure you’re able to work or provide shelter for your family. The same principle applies to taking a loan for living expenses.

Here’s what this boils down to: Higher costs that are difficult to pay at once may be more manageable when spread across several months. Situations where spreading payments support cash-flow planning can benefit from the structured approach installment loans provide. Consider whether borrowing fits within your overall budget and repayment ability.

How Net Pay Advance Installment Loans Work

Net Pay Advance offers installment loans designed with convenience and transparency in mind.

The online application process allows you to apply from home without visiting a physical location, and clear repayment schedules and rates and terms are provided upfront so you understand your payment amounts and due dates before accepting the loan.

Like Net Pay Advance’s other online loan products, it’s easy to apply for online. There’s no hard credit check, and no credit score minimum.

As a licensed lender, Net Pay Advance operates in compliance with state regulations. Same-day funding is available for approved applicants with a valid debit card in select states, helping you access funds when you need them.

Net Pay Advance currently offers installment loans in Texas and Wisconsin, with loan terms and amounts varying by state.

Responsible Borrowing Considerations

It’s important to understand your responsibilities before taking out an installment loan. Review the loan terms carefully, including the fixed or variable interest rates, fees, and length of the agreement. Make sure you can afford the monthly payments and calculate what the total cost of the loan will be. You can do that by subtracting the loan principal from your total payments.