- Net Pay Advance

- Kansas Online Loans

A better alternative to payday loans in Kansas

If you’re searching for payday loans in Kansas, consider this: A line of credit with Net Pay Advance offers similar speed and accessibility—but with more flexibility. Unlike a payday loan, you can draw funds multiple times as needed. Get fast cash the same day,* without the drawbacks of traditional payday lending.

Line of Credit

Access cash when you need it. Draw from an approved credit limit and make convenient payments. Our credit limits go up to $3,000.

Why use a direct lender for loans in Kansas?

A direct lender like Net Pay Advance is a top choice for many reasons. As a state-licensed direct lender for loans in Kansas, Net Pay Advance keeps its security processes up to date. Working with Net Pay Advance means a smoother, more transparent experience from application to funding. Our operations ensure peace of mind.

Convenient and secure

Access your account 24/7, make draws, or speak with a live agent. With no hard credit check and flexible draw amounts, you’re always in control.

Access funds when you need them

Getting funds through a line of credit in Kansas is simple. Apply online with no hard credit check and get an instant decision. Once approved, you can draw funds—up to your credit limit—whenever you need them.

Log into your account anytime to check your balance, view your loan agreement, or make a draw. Need help? Our friendly support team is just a phone call away.

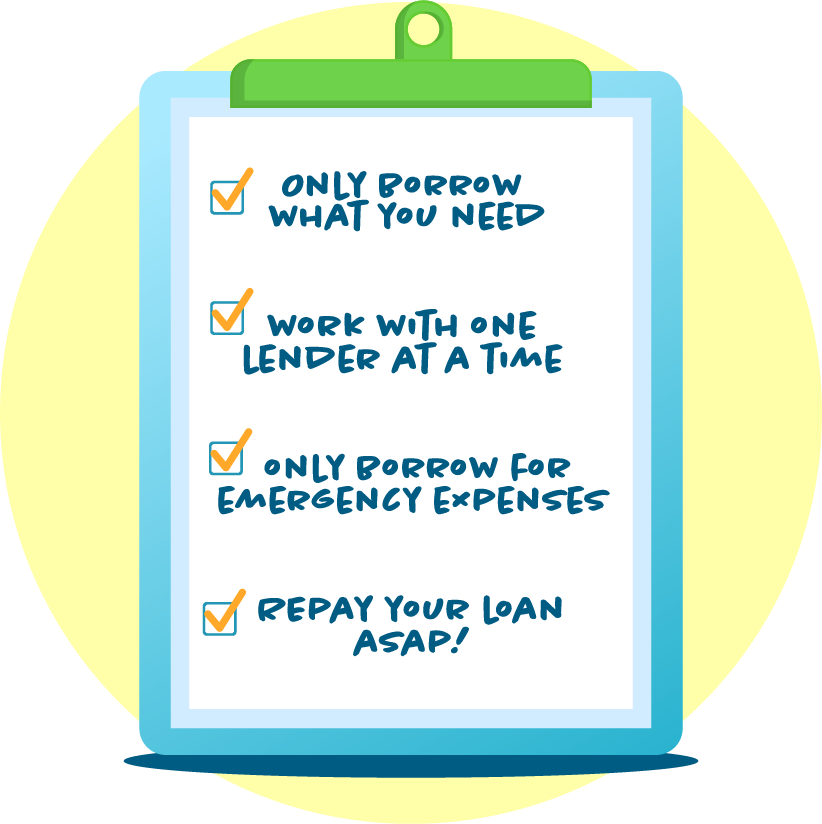

Tips for smart borrowing in Kansas

Even when emergencies hit, it’s best to:

• Borrow only what you need

• Avoid juggling loans from multiple lenders

• Use funds for essentials

• Repay as quickly as possible to save on interest

Need more time to repay? We’ve got options

Can’t pay on time? Delay your due date for 5 days—for free. Or set up a Promise-to-Pay Plan to split your payment. No stress.

Frequently asked questions

Related Articles