Smart steps you can take today to protect your identity and your money.

Online scams are on the rise—and unfortunately, even trusted brands like Net Pay Advance are being impersonated. We’ve recently seen an increase in fraudulent websites pretending to be us. These sites attempt to trick customers into sharing sensitive information or sending money.

At Net Pay Advance, your security is one of our top priorities. We use the latest encryption technology to protect your data, and we never ask for payment upfront in order to qualify for a loan. We’re committed to transparency, and we want our customers to feel confident navigating the internet safely.

We’ve recently seen an increase in fraudulent websites pretending to be us. We want to bring this to your attention so you can remain vigilant and safe. If you’re ever unsure whether you’re on our official website, it’s best to go to www.NetPayAdvance.com directly or contact our U.S.-based customer service team at 1-888-942-3320 or customerservice@netpayadvance.com. We’re here to help.

How to know it’s really us.

• Our official site is www.NetPayAdvance.com

• We never ask for prepayments, gift cards, or wire transfers

• We never ask for money upfront

• Our communications come from a branded email address and a US-based number

We’re happy to verify any communication you receive—just reach out! Call us at 1-888-942-3320 or email customerservice@netpayadvance.com.

Common types of scams to watch out for

• Loan scams

• Debt collection scams

• Credit card fraud

Loan scams

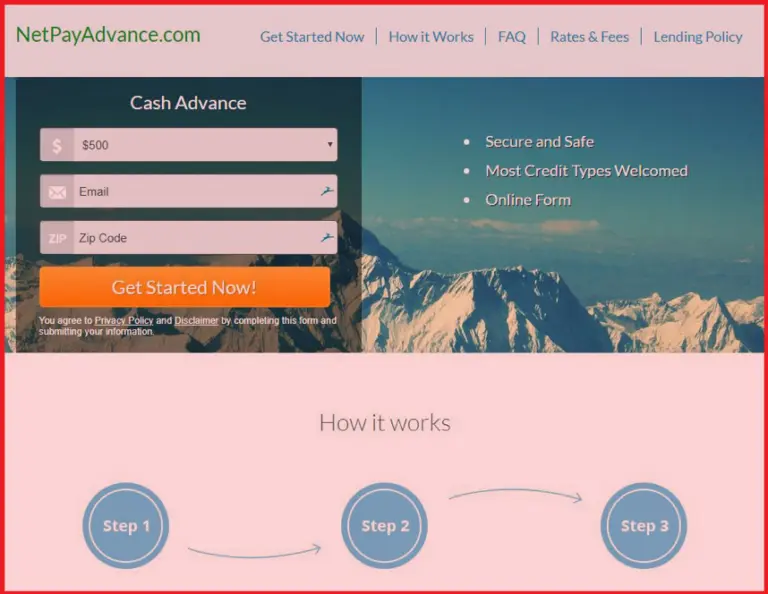

It happens when someone pretends to be a loan company, and then demands you pay money upfront in order to obtain a loan. Often times, the bad actors will impersonate a legitimate business, like Net Pay Advance, to deceive potential borrowers. Recently, we’ve seen an increase in loan scammers pretending to be us. Sites like netpayadvanceloans.com and netpayadvane.com are fraudulent and are not affiliated with us. They use tricks like removing one letter from our name or adding a word at the end of their site, to cause confusion. Do not use these sites.

Here’s a screenshot of one of the loan scams our security team came across recently.

There are far more than just loan scams impersonating Net Pay Advance. Plenty of other legitimate lenders are also being impersonated by fraudsters.

Loan scam red flags:

- They ask for money in advance via prepaid cards, wire transfers, or money orders.

- They use generic email accounts like @Gmail.com or @Yahoo.com to send account update emails.

Instead, Net Pay Advance never requires prepayment to qualify for a loan. While you may need to repay an existing loan before reapplying again, there are no upfront fees or taxes required. Net Pay Advance does not require prepayment of any amount to be considered for a loan or to obtain one.

Debt collection scams

Unauthorized individuals or organizations illegally pretend to be a lender in order to steal money through debt collection. Whereas loan scammers request money upfront, debt collection scammers pretend to be a company demanding repayment on a previous loan. Again, bad actors will often impersonate a legitimate lender, like Net Pay Advance, to deceive borrowers.

Debt collection scam red flags:

- Threatening language, such as arrest or wage garnishment

- Lack of account details or refusal to provide licensing information

- Use of generic email accounts like @Gmail.com or @Yahoo.com to send debt collection request

- Frequently they’re known to call to demand immediate payment, without sending any written communication

Real lenders will provide documentation and clear account details when discussing a past-due, or overdue balance. Legitimate lenders will also send written communication along with calling.

Credit card fraud

Any form of theft of a payment card, like a debit or credit card, is considered credit fraud. This includes the physical theft of a card or stolen information. These crimes can be committed multiple ways.

- Skimmers are devices that perpetrators put over a card slot to copy the information from the magnetic strip of the card and record the PIN number

- Phishing is when a scammer convinces someone into telling them their card details over the internet or phone

- Unauthorized payments are another form of credit card fraud

From skimming devices at ATMs, to phishing emails, fraudsters have many tactics. Improve your chances of avoid credit card fraud by doing the following:

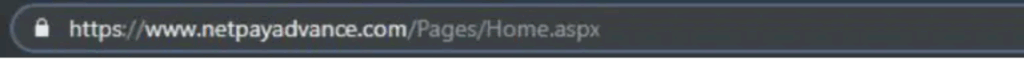

- Only shop on secure websites; look for “https://” and a lock symbol (see below)

- Shred documents that contain personal or financial information

- Check card readers for signs of tampering at gas pumps and ATMs

- Review credit card statements monthly and report unfamiliar charges promptly

- Use strong passwords, and never share them

Here’s an example of a secure website.

Both Chrome and Internet Explorer have this lock image icon like this to help keep their users safe.

Your security is important to us

Net Pay Advance is a legitimate lender, so long as you’re on our actual website. There are lot of bad actors out there, but there’s also a lot of red flags if you know what to look for. We list several more red flags to look out for on our Security Center page.

If you think you’ve been a victim of any of the fraud mentioned above, we recommend you contact the authorities. Typically that looks like:

- Contact the police at a non-emergency number to make a report

- Reporting the company to the BBB as well

In cases where a victim’s identity is stolen, there’ s more steps if your identity was also stolen around the same time.

Final thoughts: Staying safe with Net Pay Advance

Unfortunately, scammers will always exist. In the last 12 months, on average 34% of consumers have experienced financial fraud or scam.

With a little awareness and a few smart habits, you can avoid them and keep your finances safe.

At Net Pay Advance, we take your trust seriously. That’s why we facilitate real loans, from a real company, with real people ready to support you.

Last but not least, if you ever suspect fraudulent activity or see a website pretending to be us (like the recent example sites earlier, which is not affiliated with us), let us know immediately. Your report can help protect others, too!

Have questions or need help?

📞 Call: 888-942-3320

📧 Email: customerservice@netpayadvance.com

🌐 Visit: www.NetPayAdvance.com