Do you need money fast? Cash advance apps and licensed direct lenders are two options to consider. They’re similar in appearance, but there are some significant differences between them. This article breaks down these differences to help you make a more informed financial decision when the time comes. Understanding these distinctions can help you choose the option that best fits your situation. Some key takeaways:

- Cash advance apps are convenient, but you’re limited in how much you can borrow, and acquisition fees can be high if the lender is unlicensed.

- If you need a larger loan with greater transparency, exploring an online cash advance from a licensed lender may be a better fit.

- A licensed direct lender operates under strict regulatory oversight and adheres to rules designed to protect borrowers.

Net Pay Advance is licensed in multiple states and has more than 8,000 customer reviews, giving borrowers additional transparency and confidence.

Instant cash options can be helpful when you need funds quickly, but it’s essential to understand that not all providers operate under the same rules. Licensed lenders follow state-regulated fee caps and disclosure requirements, while unlicensed services may not offer the same protections.

What Are Cash Advance Apps?

Cash advance apps have gained popularity in recent years due to their ease of use and high approval rate. The amounts you can borrow are typically between $20 and $500, and repayment is usually due when you receive your next paycheck. The app connects directly to your bank account or payroll system to verify income and ensure timely repayment.

The appeal is understandable. You can download an app, complete a quick registration, and receive funds within 24 hours, sometimes on the same day that you apply. You don’t have to worry about extensive paperwork or waiting in line at the bank. This is ideal for someone with an unexpected expense between paychecks.

Despite the conveniences, cash advance apps also have several limitations. Foremost among these are the borrowing limit and the fees associated with obtaining it. Many apps charge subscription fees, express delivery fees, or “tips” that can add up quickly. Some also operate without state licensing, which can limit consumer protections.

If you need a more regulated alternative, consider an online cash advance from Net Pay Advance.

How Licensed Direct Lenders Differ from Cash Advance Apps

If you need a larger loan with more transparency, exploring a cash advance online from a licensed lender may be a better fit. A licensed direct lender is a financial company authorized by the state to provide consumer loans. Being “licensed” means the lender operates under strict regulatory oversight and adheres to rules designed to protect borrowers.

What Licensed Direct Lenders Must Provide

Licensed lenders are required to:

- Provide clear disclosures of fees, rates, and repayment terms before the borrower signs

- Follow state lending laws that limit fees and set consumer protections

- Respond to complaints that state regulators can investigate or enforce

- Operate under consumer protection laws that may not apply to unlicensed cash advance apps

- Undergo routine audits

State-by-State Differences

Licensed lenders often operate across several states, but each state has its own lending laws and regulations.

- In California, specific terminology and loanrate caps apply to short-term loans.

- Loan terms and allowed terminology may vary depending on where you apply

- Multi-state lenders like Net Pay Advance maintain compliance in every state where they operate

Borrowing Limits and Repayment Flexibility

Unlike most cash advance apps, some licensed direct lenders offer higher borrowing limits up to $3,000. That doesn’t mean the approval process will be longer. Approval and funding can still occur on the same day or next day. if you apply early enough. Net Pay Advance also offers multiple types of loans, including California payday loans, installment loans, line of credit loans, and Tennessee flex loans giving borrowers in eligible areas more flexible repayment options.

Comparing Features: Apps vs. Lenders

When comparing cash advance apps to licensed lenders, it’s helpful to look at specific factors side by side. Review the chart below for more details.

| Factor | Cash Advance Apps | Licensed Lenders |

|---|---|---|

| Licensing | Often unregulated | State licensed |

| Fees | Variable/subscription | Transparent, capped |

| Loan Amounts | $20–$500 | $100–$3,000 or more |

| Approval Time | Same day | Same day |

| Payment Speed | Same day or next day | Same day or next day |

| Repayment | App-based, or auto-draft | Auto-draft via bank account |

| Consumer Protections | Limited | Regulated under state laws |

This comparison clearly shows that licensed lenders offer stronger consumer protections and higher borrowing limits, while apps prioritize convenience for smaller amounts. The right choice depends on your specific needs. We’ll examine that next.

When to Choose a Licensed Direct Lender

The amount of money you need is one of the determinants of whether you go to a licensed direct lender or use a cash advance app. Transparency is another, and it’s right up there with the consumer protections offered through state licensing. This combination of higher bandwidth and lower risk is critical for cash-strapped borrowers.

Repayment terms should be prioritized in the lending process, but they’re frequently overlooked when the financial need is immediate. A structured repayment plan allows you to spread payments out over time. That flexibility simplifies budgeting and cash flow management. Direct lenders offer it. Cash advance apps typically don’t.

Don’t misinterpret what we’re saying here. Cash advance apps can still make sense when you only need a small bridge loan to get you to the next paycheck. For instance, you’re not likely to seek out a direct lender if you need $50 or $100 to cover groceries this week. For these minor gaps, the quick convenience of an app is sufficient.

Regardless of where you acquire funding, responsible borrowing means selecting the option that best suits your situation. Borrow only what you can afford to repay, and always understand the terms before accepting any loan or advance. Most defaults occur when repayment terms aren’t fully understood or when unexpected expenses arise.

How to Tell If a Lender or Cash Advance App Is Legitimate

Legitimacy is not measured by user experience. That shiny new mobile app or sleek website design could be masking an unlicensed lender. Don’t fall for it. It’s essential to do some due diligence before sharing your personal or bank account information. It will help you avoid headaches and financial losses later on.

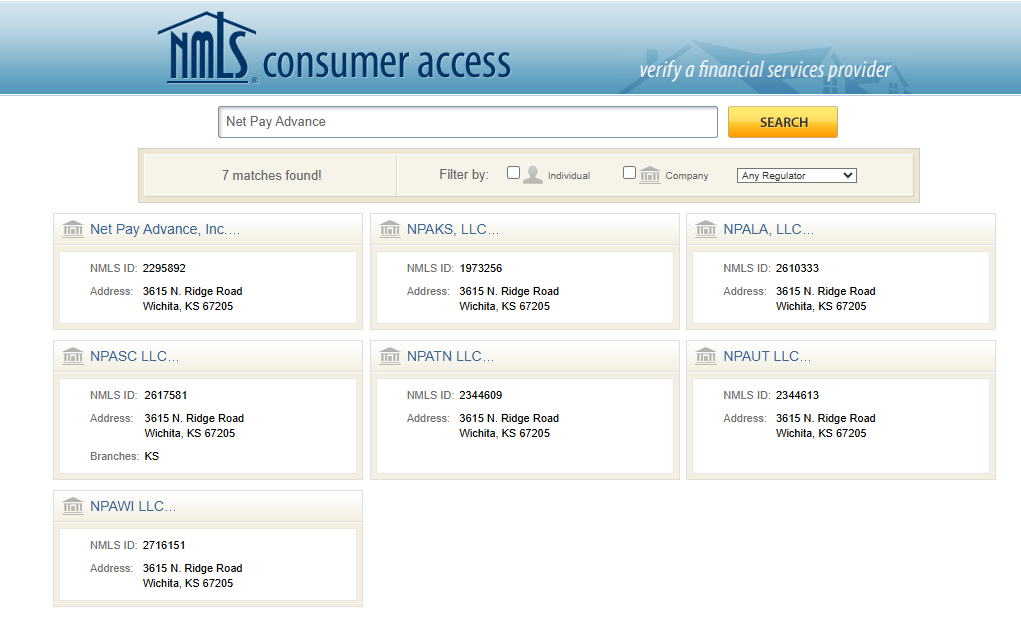

- Start with a licensing check. Licensed direct lenders are registered with state regulatory agencies. You can search your state’s financial regulator database, the DFPI (Department of Financial Protection and Innovation) in California, or the NMLS Consumer Access portal to verify a lender’s credentials. If a company isn’t listed, that’s a red flag. You can also contact lenders and ask for a license. Licensed lenders are happy to provide that. You can find our lending licenses on our website, here: Net Pay Advance licenses.

- Read reviews. Look for patterns in customer feedback. A handful of negative reviews is usual for any business, but widespread complaints about hidden fees, unauthorized withdrawals, or poor customer service should give you pause. Check multiple review sites to see if the complaints are consistent across platforms.

- Search for lawsuits. A quick Google search for the company name plus “lawsuit” can reveal whether the lender or app has faced legal action for predatory practices. While not every lawsuit indicates wrongdoing, a pattern of legal troubles suggests potential problems. Look for summaries and dispositions that show how the lawsuit was handled.

Here’s what comes up when you search for NetPayAdvance in the NMLS.

You can also review regulatory actions or formal consumer complaints, which often provide clearer insights than searches for lawsuits alone.

Learn more about Net Pay Advance’s licensing and company background here: About Net Pay Advance.

Frequently Asked Questions

Apply with a Trusted Licensed Lender like Net Pay Advance

When you need instant cash, choosing the right source matters. A licensed direct lender offers the speed you need, along with the transparency and legal protections you deserve. With clear terms, no hidden fees, and a track record backed by thousands of customer reviews, Net Pay Advance makes borrowing straightforward and secure.

Ready to get started? Apply now for a cash advance online with Net Pay Advance and experience the difference a licensed lender can make.