Did you drive with Lyft in the last year? If you made $400 or more from Lyft in the last year, you need to file and pay taxes. Let’s learn about Lyft taxes. In this article we’ll show you how to estimate payment, how to pay, and ways to save you money.

Like many people, I work a full-time job. I put in 40 hours a week and spend the rest of my time with my spouse. I don’t have a raging social life like I did when I was younger. With ample time on my hands and very few outlets, I decided to invest myself in creating a secondary income. Yes, I went ahead and found myself a side gig!

It isn’t easy to pick a side hustle, especially since there are so many to choose from. After some digging, I decided that rideshare was what seemed best. I chose Lyft and signed up to become a driver.

Need help choosing a side hustle? Let us help you!

I started the same week I signed up. Driving is fun! I basically just drove around town and picked up customers from their locations and drove them to their destinations. It wasn’t rocket science. The pay was standard, and some people are very generous tippers. I liked being able to work when I chose to work. Who doesn’t enjoy flexibility?

Making extra money is great! I enjoyed driving around familiar and unfamiliar places. I got to meet so many interesting people. The foreign businessman who is in town for work, the New Yorker who is visiting his grandparents, or the mom who needs to go places while her car is being repaired.

However, just like with everything, with pros there are also cons and, in this case, taxes are one of them.

I have yet to meet someone that enjoys doing their taxes. There are people who love numbers and like getting tasks done. However, I think they would rather do something else than doing taxes. As a driver, I now have to pay taxes.

That got me thinking. What other forms of income do I owe taxes on? Here’s a list of tax resources that could be of help to answer that question:

- Do I Owe Taxes Working for UberEats?

- Do I Owe Taxes Working for Doordash?

- Do I Owe Taxes on Unemployment?

Disclaimer: I am no tax professional. Please consult a tax consultant for personal tax advice.

Do I owe taxes working Lyft?

Yes, you do! If you worked for Lyft, you owe taxes like you would working at any job. If you made over $400 from Lyft, you need to file a tax return.

The exact amount owed is different for everyone. It depends on how much you made and the expenses you incurred in a year.

You are required to report your earnings to the IRS.

Does Lyft take out taxes?

No, Lyft does not take out taxes from your earnings. You are required to make estimated payments all year to avoid fines and penalties.

When you work directly for an employer, a portion of every paycheck is taken out for social security and Medicare taxes. Your employer makes tax payments on your behalf. If they overpay throughout the year, you receive a tax refund for the amount they over paid.

When you drive with Lyft, you’re an independent contractor. You’re considered self-employed. This means there’s no tax withholdings throughout the year, and you now need to pay your own taxes.

Let us assume, you made around $5,000 in self-employment income. You are required to pay estimated taxes to avoid penalties. You will most likely owe over $1000 in taxes.

If you need help paying your taxes, consider our online payday loan, installment loan or line of credit loans.

How do taxes with Lyft work?

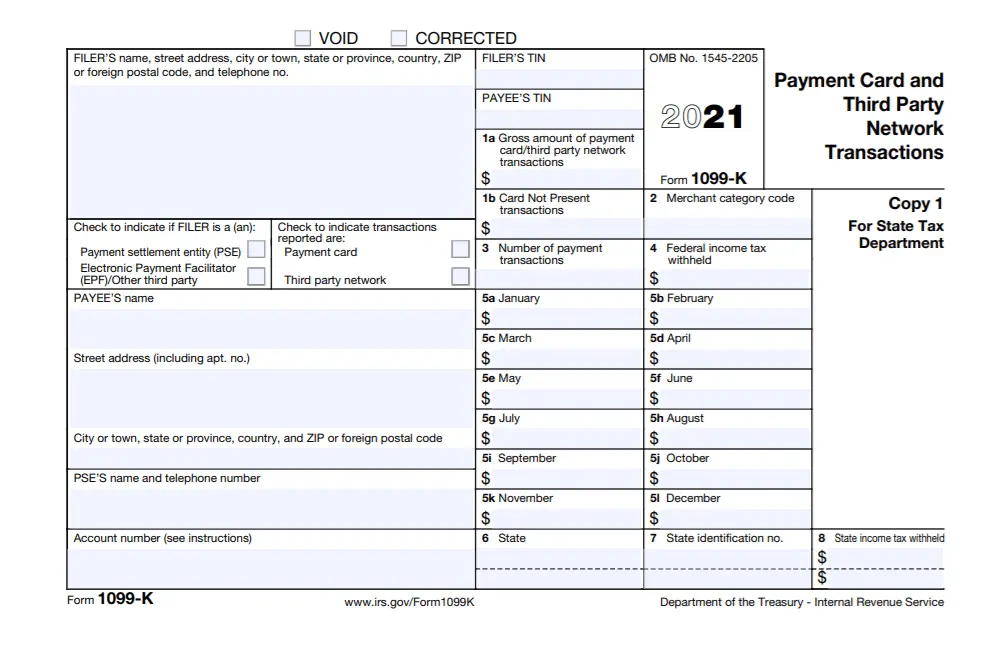

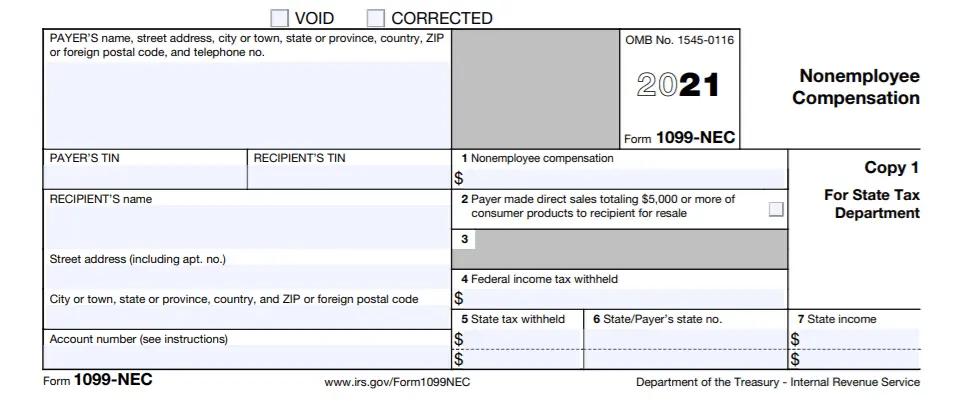

First things first, as a Lyft driver, you’re not a W2 employee of the company. You are an independent contractor. Independent contractors do not receive a W2. They file taxes using the 1099 forms.

As a driver, you usually receive two types of Lyft tax documents. There’s the 1099-K to report driving income and 1099-NEC to report income outside of driving.

If you made more than $20,000 and offered a minimum of 200 trips, you receive the 1099-K. There are different stipulations and requirements depending on your state of residency. Drivers receive the 1099-NEC if they made a minimum of $600.

Remember that you owe 15.3% in employment tax.

An interesting piece of information is that you could owe nothing in income tax and still owe self-employment tax. The self-employment tax is paid to the federal government to make contributions towards Social Security. You owe 12.4% of your earnings towards social security and 2.9% towards Medicare.

Remember that self-employment tax needs to be paid in addition to income tax.

Am I eligible for tax deductions with Lyft?

Yes, you are eligible for tax deductions with Lyft. Like any other self-employed worker, you are eligible for deductions. You are taxed on your earnings minus the deductions.

We recommend tracking your expenses and saving receipts. That’s the best way to ensure you’re taking full advantage of your Lyft tax deductions.

As a Lyft driver, your biggest expenses are associated with your car. You need to track mileage deductions to claim them as a business expense. There are two ways to do so:

Standard mileage: Multiply your business miles by 57.5 cents which is the standard rate. It includes other costs like gas, repairs, maintenance, depreciation etc.

Actual car expenses: This is a trickier way to go about tax deductions. Let’s assume that 40% of the total miles were for Lyft while the remaining 60% were personal. If you spend $11,000 on car expenses, you multiply that by 0.25.

11,000 x 0.25 = 2,750)

You get a result of $2,750 which is the tax deduction for your actual expenses. You will need to keep meticulous records of all expenses like gas, lease payments, parking fees, repairs, insurance etc.

How much will I owe in taxes working for Lyft?

The number varies from person to person. It’s unlikely to owe the exact same amount in taxes as the next person. First of all, you need to have an understanding of what will be taxed. This means, you need to be aware of your income. Next step would be to account for all your business expenses and factor those in the equation.

Income – Business Expenses = Profits. You are taxed on the profits you made working for Lyft.

It is important to track your expenses because unless you do so, you will be paying higher taxes. Also, tracking expenses help you decide if driving for Lyft is profitable for you.

For more Lyft tax information, visit their website.

How do I actually pay taxes?

Assuming that you have your Lyft tax documents, you can go ahead and fill out the forms. Or you can go online and log into your Lyft account. Go to the ‘Tax Information tab’ in your dashboard. Forms are available by January 31st.

Once you have all your tax forms, it’s time to file your taxes. There are different services you can use to accomplish this. Turbo Tax is a popular system that many people use to file their taxes from home. If you want to work with an expert, H&R Block has tax professionals to help you walk through the process. If you earned less than about $56,000 total in the last year, you may qualify for free tax filing services through the Volunteer Income Tax Assistance (VITA) program. When you owe taxes, you’re offered a few different options to make payments. There is Electronic Funds Withdrawal where you use your bank account and pay from while filing. You can opt for Direct Pay when you pay using a checking or savings account. You can use your debit or credit card to pay taxes online or by phone. Cash payments are also an option.

Self-employed workers usually pay quarterly taxes which are collected four times a year. Due dates are April 15th, June 15th, September 15th, and January 15th of the next year.

Paying taxes for an entire year of income can be difficult. Paying taxes quarterly, is preferred because it makes those tax payments much more manageable. You’ll easily cut your payment into a fourth of what it is.

If you’re having trouble paying a full lump sum of taxes this season, consider a payday loan to help cover the difference. Going forward, paying quarterly will make the process much easier. In the meantime, learn more about the best loans for gig workers.

Closing thoughts…

Living in the modern world requires one to step up and become an adult. We’ve handled a global pandemic and managed to hold on to some idea of normalcy. Some of us suffered deep personal losses while others faced loss of employment. It’s impossible to be prepared for every calamity. However, we sure can be prepared for something as predictable as taxes.

We suggest having a plan for the next tax season and hope our resources are of help to you.

If you need help paying your taxes, consider our online payday loan, installment loan or line of credit loans.