Because everyone needs help, gig worker or not

What does one do when they need money? Get a loan, right? Sometimes it may not be that simple, especially if they’re a gig worker as opposed to someone that has a steady source of income. That doesn’t mean gig workers don’t have options to get funding. Let’s explore loans for gig workers.

Not everyone you know works a traditional 9 to 5 job where they get paid hourly or are salaried. Sometimes full-time employees may even get benefits like a 401k, paid time off (PTO), or health insurance. In recent years, more and more people have been working part-time or freelancing. Some exclusively do gig work while others might do so in addition to being employed full-time. The gig industry is growing, and now gig workers currently make up about 36% of the American workforce.

With inflation being what it is, more and more Americans are resorting to gig work often as a side hustle to supplement their income. Besides, gig work can be rewarding in many cases. For instance, UberEATS drivers can make over $20/hour in some states! Some gig workers monetize their passion such as selling crafts on Etsy or offering piano lessons. Either way, gig work has helped several people put food on their tables during tough financial times. It continues to help people provide for themselves and their families.

We’ll explore loans for gig workers in a moment. Before we dive deeper, let’s break down what gig work is and what it entails.

What is gig work?

Gig work can be defined as a system where instead of making a regular income, workers are compensated every time they complete a task or gig. Such jobs are usually flexible, and the workers are self-employed. They work on a contractual basis like freelancers for jobs that are temporary.

Examples of gig work:

- A firm appoints an individual to build them a website.

- A contractor hires several individuals to work in construction of a home.

- Someone signs up to drive for food delivery or rideshare companies like DoorDash, Uber, Lyft, Instacart, or Postmates.

Struggles of gig workers explained

Gig work offers people the autonomy of working for themselves and being their own boss. It also offers flexibility in the sense that workers can choose and pick gigs depending on what fits their schedules and requirements. However, being a gig worker can come with struggles.

For starters, gig workers don’t get paid if they don’t work since they don’t have sick days or paid time off (PTO) like direct-hire employees do. There are no benefits for gig workers. There is often an element of uncertainty as gig workers don’t know when their next gig arrives. Since gig workers are paid after a job or gig is completed, their cash flow is inconsistent. Having a fluctuating income can be tough and might require one to seek financial help on off weeks when the ends don’t quite meet.

People with steady and consistent paychecks deal with unexcepted expenses, but gig workers face unique unexpected expenses. Gig workers that drive their own car may face more unexpected car repairs. Gig workers may need to buy things like insulated bags to carry food in.

One of the most unexpected expenses gig workers face is during tax time. Since gig workers are considered self-employed individuals, that means they must file and pay taxes on any income earned. It’s common for gig workers to be surprised by a large tax bill during tax season.

Take a look at our taxes for gig workers articles:

- Do I owe taxes working for Doordash?

- Do I owe taxes working for Lyft?

- Do I owe taxes working for UberEATS?

- Don’t let Uber tax documents confuse you!

- Postmates taxes: The complete guide

- What you need to know about Instacart taxes

- How to prepare for filing your taxes

What’s a gig worker supposed to do when they’re faced with hundreds of dollars in taxes, after just making ends meet?

Payday loans for gig workers

Payday loans are short-term loans that help people catch up with bills or handle unforeseen expenses or emergencies that can’t wait till their next payday. A payday loan may also be referred to as a cash advance.

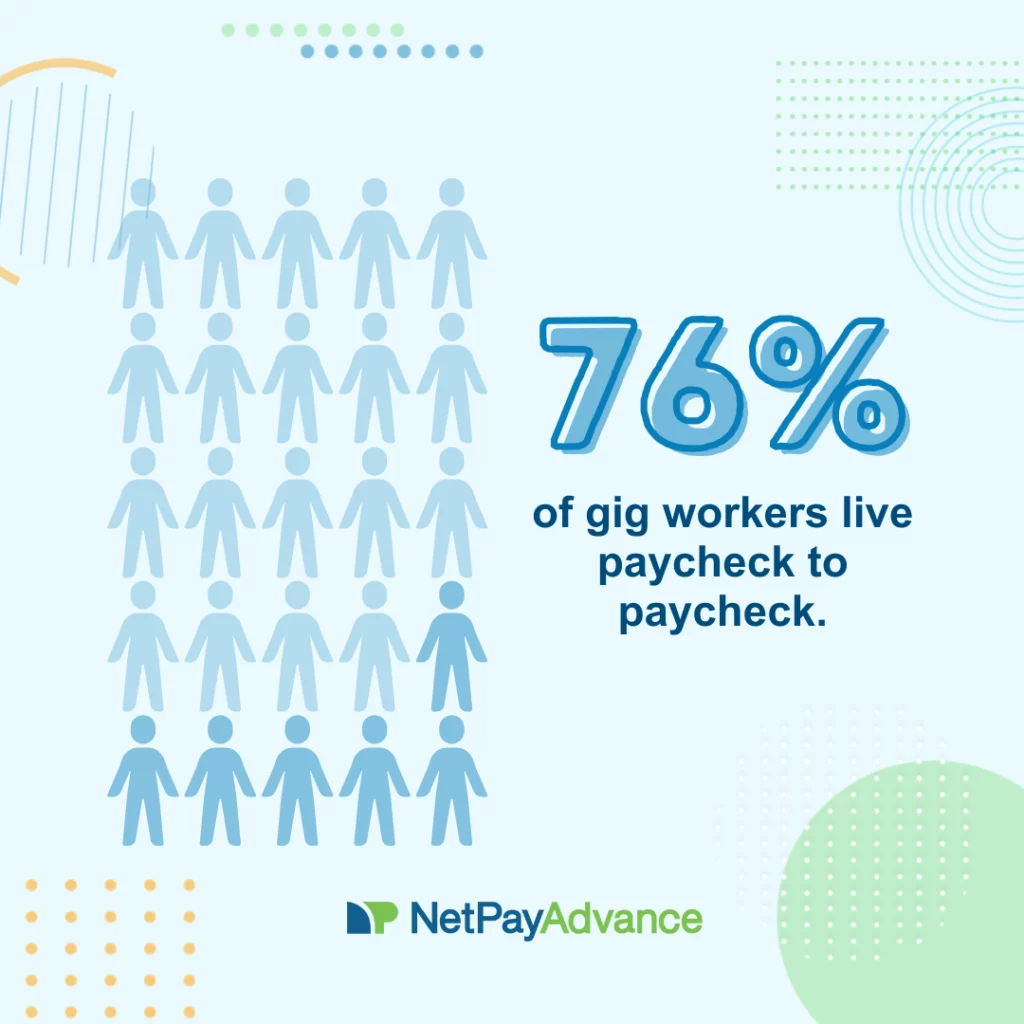

3 out of 4 Americans live paycheck to paycheck. Health issues, car troubles, home repairs, etc., can strike at any time and might require you to spend more money than you had budgeted initially. As a result, you could end up strapped for cash and need funding.

Check out the 7 best payday loans for fast funds if you’re looking for a way out of your current financial crisis by means of a cash advance.

Eligibility for payday loans is often based on the applicant’s ability to repay the loan. There’s no secret that having a consistent paycheck can help. Not every payday lender is able to lend to gig workers. Some lenders, including Net Pay Advance, do accept gig work income as a type of income. We offer loans for gig workers.

Discover more about payday loans online.

Why should gig workers apply for a payday loan?

There are a few reasons why gig workers should apply for a payday or cash advance loan. A payday loan typically features the following:

- No hard credit check

- Easy to apply online

- Quick approval decision process

- Fast funds

- Excellent customer support

A cash advance or payday loan is a one-click solution to kiss your financial troubles goodbye. It is a simple fix that can provide funding when times are hard. The key is to work with a legit and trusted lender like Net Pay Advance and find the best online payday loans for you.

Remember to work with a lender that has social proof and credibility. One way to ensure this is to look up online reviews.

![Light blue background bears the Net Pay Advance logo and brand name at the top. 5 stars enclosed in a solid white rectangle rests on the top edge of a solid light green rectangle featuring a customer review that says, “fast response, live human, understandable, knowledgeable, [and] courteous agent. People who find themselves unexpectedly in a rough spot need companies like Net Pay Advance Inc.” The review is from LA. Bottom-right shows a gig worker holding a food delivery bag with the Net Pay Advance logo.](https://netpayadvance.com/wp-content/uploads/2023/10/Review-LA-1024x1024.webp)

![Light blue background bears the Net Pay Advance logo and brand name at the top. 5 stars enclosed in a solid white rectangle rests on the top edge of a solid light green rectangle featuring a customer review that says, “I was in a very tight bind at the beginning of the week. And thanks to Net Pay approving me so quickly [I had funds] available right away.” The review is from Amanda. Bottom-left corner shows a gig worker on a moped delivering coffee.](https://netpayadvance.com/wp-content/uploads/2023/10/Review-Amanda-1024x1024.webp)

How can gig workers prove their income?

When one applies for a short-term loan or cash advance, they are usually required to submit proof of income. For gig workers, proving income is a little different. Unlike direct employees, they don’t get a W2 form. So, they must use the following when trying to show proof of income:

- Paystubs

- Tax returns

- Bank statements

- 1099 form

- Correspondence from their accountant or clients

At Net Pay Advance, we are familiar with the nature of work gig workers do and sign off on loans for gig workers just as they do for anyone else meeting funding requirements. Also, we accept several different types of income such as paychecks, Social Security, retirement, pension, and more!

Check out the 7 best payday loans for fast funds if you’re looking for a way out of your current financial crisis by means of a cash advance.

What other options do gig workers have?

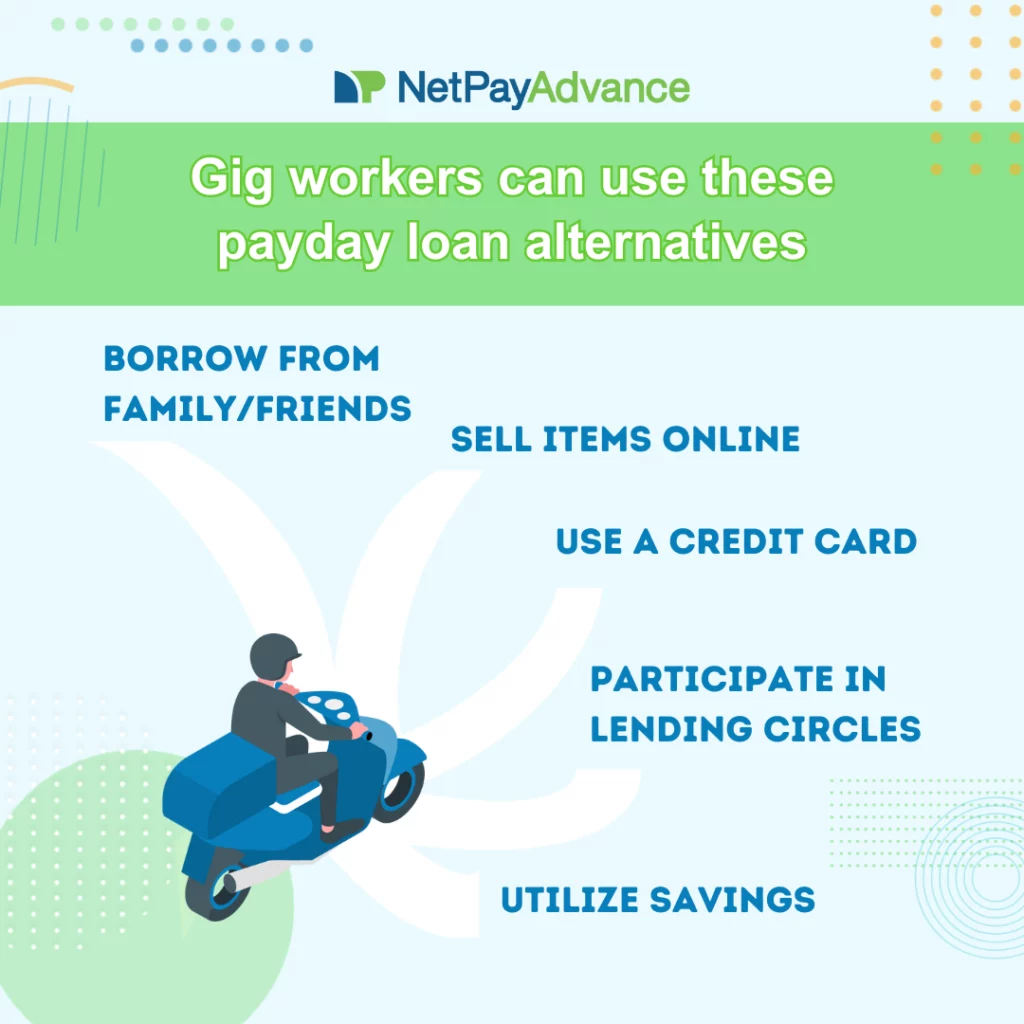

Gig workers, like anyone else, might not always have the option to take out a cash advance loan. Instead of loans for gig workers, they could explore funding alternatives such as borrowing from friends or family, dipping into their savings or using a credit card.

If loans for gig workers aren’t what you want, explore our detailed list of payday loan alternatives. We think it’s important for you to know your options.

Need funding? We can help!

There’s no shame in having money troubles. In fact, 70% of Americans report feeling financially stressed. You’re not alone and there are ways for you to get help. If you need money fast, we suggest checking out our list of 15 tried and tested ways to get fast cash. And if you’re wanting a quick fix for a tricky situation, a cash advance might be just what you need.

Net Pay Advance is a leading lender for fast online payday loans. We are dedicated to providing quick financial relief to thousands of people across the country. Read over 8,000 5-star reviews that say we deliver the best loans online for meeting urgent expenses.

At Net Pay Advance, we try to spread financial education through our personal finance blog along with offering loans for gig workers and for those who need funding. See more about our online loans that we offer.