Investing tips to help you get started

Last week, we wrote about how you can make your money work for you. This week we’re going to expand upon one of those possibilities – investing! We have some investing tips for you.

Beginner? Join the crowd. Only about one-third of U.S. adults personally own stocks outside of a retirement account. That means that two-thirds of U.S. adults have no personal stocks outside of a workplace retirement account.

We know that investing can sound overwhelming and complicated. It is normal to feel intimidated. Investing isn’t child’s play. Our investing tips are meant to help make investments seem more achievable. This is especially true for those who don’t know much about it or don’t know where to start. So – what should you do or know before you start investing?

Investing Basics

Here’s a time when being basic is actually a good thing.

Technology has made investing more accessible than ever. It means you don’t have to rely on a complicated strategy nor be a math wiz to start making money. With oodles of investing options, you can create an investment plan that matches your risk and skill level.

Rather than making detailed plans, your goal is to create a basic plan. Investing today can be as hands-on or hands-off as you wish. However you decide to go, you must have a plan. A smart investing tip is to have a plan even if it isn’t perfect.

Listen, investing is volatile. Your goal with investing is not to outsmart the market or predict the future. Develop an investment plan built on a well-defined and solid foundation.

In the end, your investment plan should break down into three primary objectives.

- Set clear goals

- Seek smart advice

- Know your limits

How to Plan your Investment Goals

Before you can even get to the investment part of things, you need to look at your personal situation, finances, and goals. The point of investing is to make money, but if you do it irresponsibly, it may do more harm than good.

First, think about what exactly you want to get out of investing. Are you trying to earn money now or earn the most you can for the future? Is this going to be a source of usable income, or is it going towards a retirement plan or other savings account? Create a list of goals you’re trying to achieve financially. This list can help you decide if you’re looking for short, mid, or long-term investments.

Next, look at your finances and your personal circumstances to determine how ready you are for investment. How much money can you budget out for investing from each paycheck? Are you in a good position to be able to handle an investment that falls through? When are you expecting to get your profit from investing? What kind of investments do you want to make that are beneficial to you? Ask yourself these questions and any others that arise to figure out how ready you are for investing.

Types of Investments

There are two major types of investment. They each come with unique characteristics, benefits, and risks. Let’s take a look:

1. Growth Investments

These are usually long-term investments. They have the ability to tolerate the highs and lows of the market. In these investments, the focus in on increasing investor’s capital. Growth investments are popular because there is the possibility of making impressive returns. Examples: Shares – when you invest in a company that is expected to increase their earnings at a better rate in contrast to others in the market.

Property – Real estate is one of the most common types of investment. You can acquire property to turn it into a rental. Or you can improve and flip it for a higher price.

Growth investments are a good choice when you have long-term plans and goals, and the market is relatively doing well.

2. Defensive investments

These are generally considered to be lower risk than growth investments and they focus mainly on generating income. In addition, defensive investments are meant to lower the risk of losing your capital. The growth rate is usually modest. Examples: Cash equivalent – This include savings accounts, money market accounts, certificates of deposit (CDC) etc. All of these offer a stable rate of return along with lowest potential returns.

Fixed interest – These are essentially bonds. The government or other entities often borrow money from investors on interest. This is a fixed rate of interest. They are low risk and have lower potential returns.

Defensive investments are the way to go when the market is volatile or is expected to take a downturn.

Do some research. Look into getting a guide to investing, watch videos with tutorials and advice, or contact a professional. Take notes of terminology, questions you have, and other important things to know about investment so that you’re thoroughly prepared and knowledgeable before you dive in.

Start researching

Before you dive in with both feet, it is important to do some research. There is so much to know and learn in the realm of investments. You don’t want to venture out unprepared. We suggest looking up some terms and topics like:

- The different types of investments you can make as discussed earlier

- If you want to enlist the help of a broker or brokerage for your investments.

- Basic terminology:

- Stocks: These are a type of equity that represent ownership of a portion of a corporation

- Bonds: They are loans issued by an investor to a borrower over a period of time where the investor gets interest payments.

- Dollar cost averaging: An investment strategy where you invest around the same amount of money at regular intervals. Over time, it is perceived to help lower investment costs, minimize risks, and enhance returns.

- Capital appreciation: Increase in the market price or value of an investment.

- Risk tolerance: The level or amount of risk an investor is willing to take in regard to the decrease in value of their investments.

These are just a few ideas – there are plenty of words to familiarize yourself with! Make a list of definitions to keep yourself on top of verbiage in the investment world.

We hope our investing tips prove to be useful. Talk to professional investors or investment bankers. They’ll have the experience and knowledge to help you answer any questions or explain processes that you don’t understand. You might also want to talk to the people around you – family, friends, coworkers – to learn about their investment experiences to see what advice they might have to offer you.

Diversify Your Investments

You should diversify your investment portfolio. Professionals recommend seven to ten investments at a time because variety tends to be more beneficial than just two or three investments. However, that doesn’t mean you should invest in anything or everything. Start with things that are familiar to you, that interest you, or that you directly benefit from.

Low risk is better for beginners! Avoid stocks with notorious risks like high percentage chance of loss or underperformance.

Investment Services

Intuitively, online investment services get to know you by learning your goals, timeline, and risk tolerance. These are the same questions a human financial advisor would ask.

Then, the service may deploy a robo-advisor.

This helps the service automate the investing process.

Is it risky? Quite the contrary.

Humans are working behind the scenes, teaching the robo-advisor best practices.

Anyways, the robo-advisor builds a personalized portfolio. It uses an algorithm to select investments for you. Likewise, it monitors your portfolio and looks for opportunities to buy or sell assets. It adjusts so that you stay on track to meet your goals.

Robo-advisors build portfolios on index funds and ETFs rather than investing your money all in one fund. ETFs are diversified stock groupings, which are less risky and tend to increase returns over time.

Robo-advisor services come without the costly management fees and trepidation of a human advisor. Similarly, they require less money to start than traditional services.

There are several options in this space. Our personal favorites are Betterment and Wealthfront. (Quick note: We’re not affiliated with any service in this space. Recommendations are all our own).

Furthermore, these services make starting an investment portfolio simple. Plus, the cost is minimal. Typically, management fees are less than 1% of the amount you invest.

That is to say; procrastination will cost you. Waiting may cost more than your advisory fee.

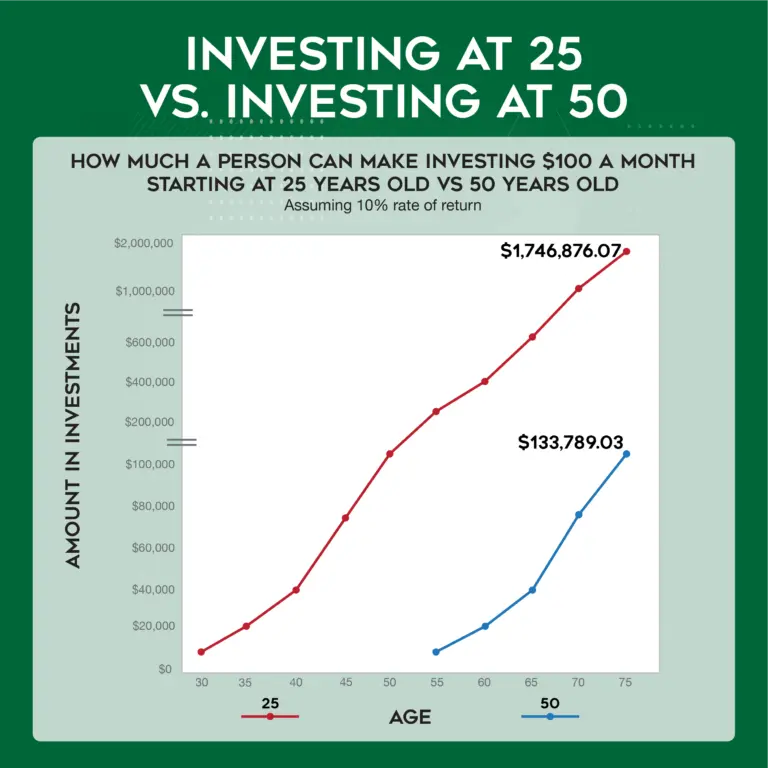

Put simply, longer investment plans are less risky and tend to yield better returns. Even more, those who start investing earlier are more likely to make more money than those who wait to start.

Pro tip: Everyone has a fear of mistiming the market. It’s hard not to watch the scoreboard. Dollar-cost averaging is an investment technique where you invest a fixed amount regularly, regardless of the market price. It evens out the price you pay. Dollar-cost averaging doesn’t lower your risk investing. But it does lower the perceived risk, and makes it emotionally easier to invest.

Is now a good time?

You have questions. For starters, you want to know: When should I invest?

It’s basic human nature to plan for the perfect moment. But with investing, there’s never a perfect moment.

It’s essential to start investing as soon as possible – yes, that means the younger, the better! This is largely in part due to compounding: the process where earnings like capital gains or interest are reinvested to generate more profit over time, meaning the initial principal invested and the principal’s earnings will both start bringing in financial returns. The earlier you start investing and bringing in earnings, the more earnings you can expect years down the line.

Today the stock market is up. Tomorrow it may be down. Trying to keep up with the ebb and flow of the market is challenging, if not impossible. Following day-to-day market fluctuations can feel like riding a roller coaster. Quick dips and winding turns aren’t as fun when they involve your money.

But it’s hard to win the game when you’re constantly watching the scoreboard.

Investing is not about getting rich quickly. Your focus should be to grow your money long term.

So, when is the right time to invest?

There’s no time like the present.

Know When to Stop

With investing, it’s easy to overcrowd your mind with information. To ease decision-making pressures, we tend to collect more information than we need.

My advice: know when to stop.

More often than not, success in investing is linked to choices you don’t make.

Above all, make a plan and stick to it. Yes, research is an important element in investment strategy. Just know when to stop. And then stop.

Once you’re investing, take a back seat and let your investments work. Your investments won’t perform any better the closer you follow them.

Stressing over market fluctuations will only increase your blood pressure.

The fastest way to get to know investing is to get out there and do it. Start with these tips, then get going! The more you plan for and research your investments, the more likely you are to experience success. Experience in general is going to guide you to where you want to go, so open that investment account and start your plan of action of garnering returns!