Is a car title loan right for you?

Imagine this: an unexpected expense, like a medical bill or car repair, has left you in a bind, and you need cash fast. You don’t qualify for traditional loans, so you’re comparing options. If you own a car, you know a title loan could get you cash quickly. But is it worth the risks?

A car title loan allows you to borrow against the value of your car using it as collateral. Intended for those with limited access to other financing, title loans can come with high interest rates and short repayment terms, usually 30 days.

In states where title loans are allowed, you bring your vehicle and documents to the lender, who verifies your information and inspects the car before giving you the cash. The loan amount is usually 25% to 50% of the car’s value. The lender keeps the title and puts a lien on the car until the debt is paid.

What this article covers:

- What documents you need for a title loan

- How to navigate the title loan application process

- Tips for getting approved

While Net Pay Advance does not offer title loans, we do think it’s important for our customers to know what options they have. That allows them to make the lending choice that’s best for their needs. This article gives look into what a borrower could expect when considering a title loan. If you’re considering a personal loan or payday loan, Net Pay Advance is a lender thousands recommend.

Tip: Don’t get auto repair financing confused with title loans. They can be two separate types of loans. The first describes the purpose of the loan. The second describes the collateral used for the loan.

Documents for a title loan

Getting ready for a title loan? Here’s what you should expect. Different lenders may have their own quirks, but most will ask for the following documents before they can approve your loan:

- Vehicle title

- Government-Issued ID

- Proof of Income

- Proof of Residence

- Vehicle Insurance and Registration

Vehicle title

First things first—you’ll need a clear vehicle title in your name. This shows the lender you’re the owner and have the authority to use the car as collateral. If your car is still under financing or has another loan tied to it, that can be a deal breaker since other lenders might already have a claim on it.

If you’re not sure how to get your car’s title, check with your state’s Department of Motor Vehicles (DMV). Usually, you’ll need a signed bill of sale from the previous owner and a VIN verification form to prove the car’s identity.

Need a loan without using your car as collateral? Explore personal loans online—these options may let you borrow without any collateral required.

Government-issued ID

Your ID confirms who you are and ties you to the vehicle title. Most lenders will accept an unexpired driver’s license or a state-issued ID. Double-check that the name on your ID matches what’s on the vehicle title—any mismatch can slow things down and even complicate the loan process.

Proof of income

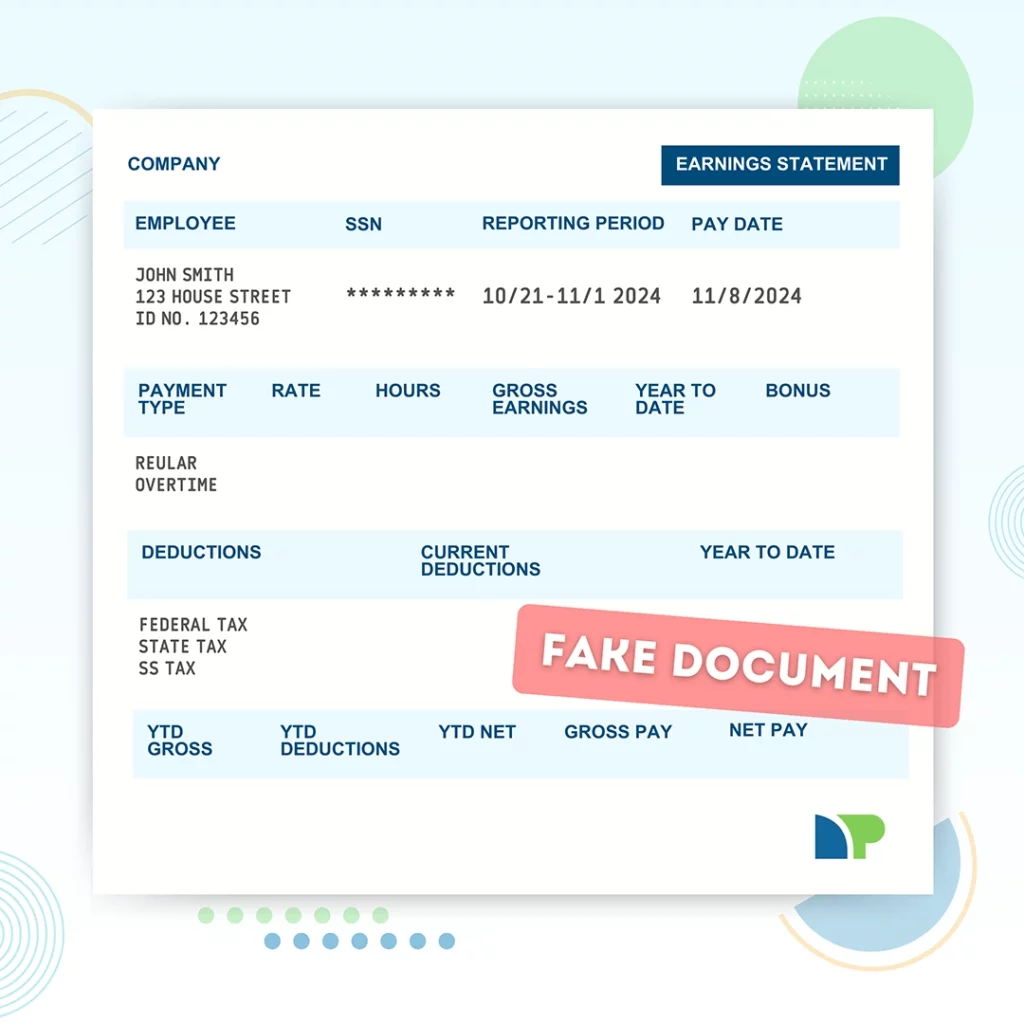

Even though the car is collateral, lenders want to know you have an income to make those monthly payments. Bring a recent pay stub, an offer letter, or a bank statement to show you’re financially stable enough to repay the loan. Some lenders might also accept tax returns or other documents, so check with them to be sure.

Proof of residence

Most lenders will ask for proof of where you live—usually something like a utility bill, a lease agreement, or a mortgage statement. They want to make sure they can reach you if needed, so try to match this address with what’s on your driver’s license or registration to avoid any confusion.

Vehicle insurance and registration

You’ll need to show current insurance and registration for your car. The registration proves you’re the one who has the legal right to operate the vehicle, while insurance protects both you and the lender if anything goes wrong with the car before the loan is paid off.

What if I don’t have all the necessary documentation for a title loan? If you don’t have the necessary vehicle documents, consider emergency loans online for quick cash without collateral. Considering the list above, personal loans usually only require confirming your address and proof of income.

The title loan application process: Step-by-step

Want to get through this process quickly? Have all your documents ready! Whether you’re applying online or in person, here’s what the typical steps look like:

Step 1: Fill out the title loan application form

Start with the basics—most applications ask for contact details, income info, loan amount, and car details. Be as accurate as possible to keep things moving smoothly.

Step 2: Collect and submit required documents

This is where you’ll hand over all the documents we mentioned above. If you’re applying in person, some lenders may need to see originals, like your ID and title. Online? You’ll probably just upload copies.

Step 3: Get your vehicle inspected

The lender will inspect your vehicle to estimate its value. Your car’s value combined with your income, will help determine your loan amount. If applying online, you might need to send recent photos, a maintenance report, or a CarFax report to verify the car’s condition.

Step 4: Review approval and loan terms

Once the lender has everything, they’ll decide if you’re approved and send the terms for you to review. Pay special attention to the interest rate, repayment period, monthly payments, and total interest. Know what you’re signing up for!

Step 5: Sign and finalize the loan agreement

If you’re ready to accept the terms, you’ll sign a few forms, including the loan agreement and a security agreement, which confirms your car is the collateral. Once that’s done, you’ll get your funds.

Tips for getting approved

Here are some quick tips to make your application go more smoothly and help you avoid any hidden surprises:

- Prepare: Gather your documents ahead of time and double-check that all the info is consistent. Small discrepancies can delay things.

- Ask: Call or visit the lender to confirm what documents you’ll need. This can save you an extra trip or hassle.

- Review: Carefully read the loan terms, and don’t be afraid to ask about fees, interest rates, and any early payment penalties. If you’re signing a document, you deserve to understand the terms.

- Consider Other Options: Before signing, think about other ways to raise funds. Selling personal items, asking your employer for an advance, or borrowing from friends or family. Personal loans online are another option that doesn’t require collateral.

- Use Title Loans as a Last Resort: Remember, title loans can be costly, and missing payments could mean losing your vehicle. Make sure it’s the right choice for you before committing.

Conclusion: Is a title loan for you?

If you have an unexpected expense and need cash now and other options aren’t available, a title loan can be a fast solution. But what do you need for a title loan? By using your car as collateral, you can get funds with a simple application process as long as you have the required documents ready. But be aware of the high interest rates and short repayment terms.

In a nutshell, here’s what a title loan is:

- Fast access to cash when you need it

- Simple approval if you have a clear title and documents

- Using your vehicle as collateral

But be aware of the risks. Missing a payment can mean additional fees or losing your vehicle. So before you decide, consider all your options. Personal loans online are another option that doesn’t require collateral and may suit your needs. A title loan is a last resort, but only if you’re prepared for the terms and costs. By knowing the process and what’s required, you can make an informed decision that fits your financial situation.