What is fun money? Why you should include it in your budget

Many see a budget as a guide for what they can’t do. But done well, a budget can give insight to all the fun things you can do. If you’ve woken up to an empty bank account and wondered where your money is, a well-defined budget may be what you need. Follow our guide to learn what fun money is, what it isn’t, and how much allowance you should give yourself.

It’s Saturday night in December. For the umpteenth time, I’m trying to rediscover a sensation known as “fun.”

Remember fun? Hardly do I recall the phenomena.

Ten months into the pandemic, I have lost track of what fun is and what fun is like. March reminded me that home is where the heart is — and where the entire year is. But now we’re crossing into a new year, and I’m stoked.

Vaccines are anticipated to be widely available in the spring. Like the long-awaited debut of a new Beyoncé album, the day can’t come soon enough. Eagerly, I wait for the return of normal life — and the return of fun. Fortunately, that day is on the horizon. But not all is fine and dandy.

I’ll be the first to admit, I’m not quite as financially prepared as I’d like for fun’s grande return. See, when things were normal, a night out might cost me a hundred bucks. That much I’d become used to. But in the pandemic, that $100 night out transitioned to a semi-weekly Amazon splurge. These unscheduled splurges function like an extra cheesy deep dish pizza to my diet — not helping.

I need an allowance, a budget fix … a rehaul of sorts. But I have an affinity for extra cheesy deep dish pizza. Similarly, I also favor the occasional unplanned spending splurge. Moderation is a good thing, at least that’s what I’ve heard.

“What’s in a budget?” I ask.

Here’s what I now know about budgets, fun, and extra cheesy deep dish pizza.

Budgets: A diet for your money

Budgets and diets are a lot alike. Done well, they’re intentional. Planned actions lead to results.

If I want to get my budget into shape, I need a detailed plan. A diet, if you will.

Expert dieters say an occasional cheat day won’t ruin your progress. Likewise, an occasional splurge probably won’t totally derail your budget. Pro dieters actually plan a cheat day. Why? Planning keeps you from having one too many cheat days. Plus, scheduling out a cheat day tends to make it more enjoyable.

So let me tell you some magic words: Pizza belongs in your diet.

(at least that’s what I’m telling myself).

I’m not kidding. But don’t think too much about the pizza. I don’t literally mean a deep dish pizza. I’m asking you to identify the extra cheesy deep dish in your life.

Pizza is a metaphor for fun money. Every budget — yes, even yours — needs fun money.

What fun money is and isn’t

You may have just started your debt free journey. If that’s you, there’s a strong likelihood you turn down any extra costs not already neatly fixed in your budget.

It’s kind of like someone starting a diet who will turn away any snacks unless they’re diet-approved. Even the strongest-willed give in after time. And that’s OK.

Some self-care is important. You need to treat yourself, at least a little. Budgeting in a little fun money helps keep your budget in line without sending you financially overboard.

Important to remember, fun money is intentional and focused. It’s not an excuse to be wasteful or engage in a spending free-for-all. This is money you set aside for something you don’t need but really want. Need a little more definition? Fun money is dollars spent on stuff you want and buy, guilt-free. Think of it as a personal treat you fix into each month — be it a night out with friends or a nice gift for yourself. How you spend your fun money is yours to decide.

Fun money is not used for bills, debt repayment, or other scheduled payments. It’s used for, well … fun! Some people refer to fun money as pocket money, or the money you carry in your pocket to spend when the mood strikes you. You should use your fun money for fun.

But remind yourself this: When fun money is gone, it’s gone. You’ve set some boundaries, and now you need to stick to them.

How to plan fun money in your budget

You’ve seen an expert dieter. They have every food and beverage written out precisely. Pro budgeters spell out every dollar, too.

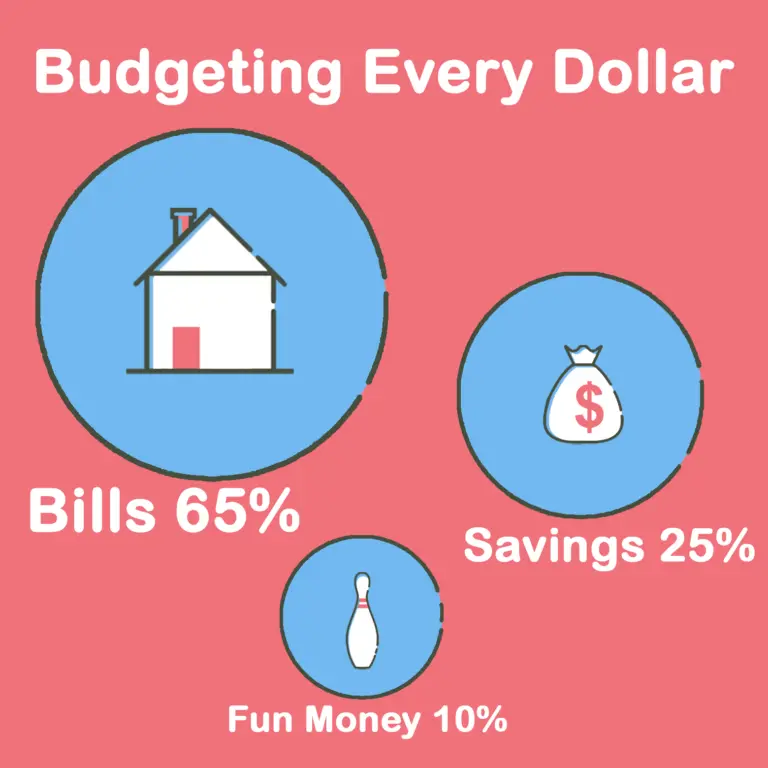

A budget is giving your money a purpose. It’s having a plan for all that’s coming in and going out. Having a budget helps you get ahead on your money. An every dollar budget is my favorite, as it’s easy to track. It works by giving every dollar coming in and going out a name. This practice is the basic function of a zero-based budget.

With a zero-based budget, the number coming in minus the number going out should equal zero. Every dollar has a purpose and is sent in a specific direction. That includes your fun money.

But the more specific you can get with your fun money, the better off you will be. Try not to use fun money as a $500 monthly catch-all for expenses you weren’t willing to name. Budget events that occur regularly, like a monthly dinner with friends, outside of your fun money bank.

You decide what fun money is and how you use it. After all, it is your money.

Should you up your allowance? How to know when

People tend to either overdo or underdo fun money.

I like to think of fun money as an allowance I give myself. It’s nothing big — just enough to give me a little wiggle room. I make a conscious effort to keep the proportions right. Because if I allocate too much to my fun money bank, I tend to knock my entire budget plan off track.

Also, I treat my fun money like it’s use it or lose it. Any portion of my fun money I don’t use, I move over to my savings. I do this because I like consistency. Plus, I don’t want to get accustomed to a larger total one month and have less to spend the next.

So, you’re probably wondering what a healthy allowance is. Your answer is … Well, it’s complicated. One popular suggestion is 30%, as follows with the 50/30/20 budget strategy. It breaks down like so.

- 50% needs

- 20% savings

- 30% wants (a.k.a. fun money)

But personally, I don’t like to budget that way. I have a feeling this one-size-fits-all approach doesn’t really fit all. There aren’t any restrictions with this budget, other than to not exceed 30% of your monthly income on discretionary spending. A loose plan like this may make it hard to track progress and keep you from hitting your goals.

Instead, you should aim for a more specific allocation to stay in line with your goals. Some experts suggest the magic number is 10% of your monthly income, after taxes. I think the right amount should be somewhere in the range of 5-10% per month. Under this fun money umbrella are trips to the bar, the movies, weekend road trips, spa days, etc.

I’ll admit, 10% sounded like far too much for me. Then I took a look at my last month’s credit card statement. I may have exceeded that 10% threshold … after two weeks. You don’t want that. Likewise, it may be that 10% is a little too much. You can tinker with this total as you like to find the right fit. But I suggest holding to 10% at a maximum. If yours is higher than 10%, you could probably stand to make your budget a little more specific.

I recommend budgeting 10% of your monthly take home pay, after tax, for fun money. But only you will know for sure if 10% is right for your budget. Use this calculator to determine what 10% of your monthly take home pay, after tax, would look like in dollars. If that looks right, then great! If not, feel free to adjust until you find a number that feels right.

Think about the fun expenses you had over the last week or two. How much did you spend? Consider if those expenses became a weekly occurrence. Would it leave you with enough money to cover other necessary expenses and bills and still save money? Use the calculator below to determine your fun money.https://www.embed.com/app/calculator/gray-calculator.html

Calculation: Your income ÷ 10

This is how much I recommend you budget as fun money, represented in dollars.

Dude, where’s my paycheck?

Budgets have a bad rap. I used to think of a budget like my sometimes overprotective parents always telling me no. It wasn’t until recent years I realized that a good budget is less like an overprotective parent, and more like a cool uncle who keeps you out of trouble, but lets you have fun.

If you used the calculator above to figure your fun money total, you’ve already started budgeting. It’s easy to keep going. So keep going.

Fun is around the corner and we all can stand to improve ourselves financially for the year ahead. Let’s talk more about the fun stuff and less about how we’re going to afford it.

I don’t want to wake up to an empty checking account, and I know you don’t either.

Net Pay Advance recognizes the financial strain people across the country are facing.

We want to help. We’re publishing new content every week to help people rediscover financial independence. Visit our blog to stay updated with resourceful money success tips. To stay up with new posts, subscribe to us on social media. Also feel free to suggest a blog topic you’d like us to discuss next. We’re here to help you any way we can.