Unexpected expenses can be inconvenient or a financial dilemma. These “dilemma” expenses are what we’re referring to when discussing emergency loans. They’re costs that appear out of nowhere that can’t be covered without borrowing money. Common examples include medical bills, car repairs, and family emergencies.

Another factor that makes these dilemmas emergencies is the urgency of the needs. You may not be able to wait for a traditional loan to be approved. Emergency loans are short-term financing options. Ideally, the lender will offer same-day approval and next-day funding, sometimes even faster. This article explores how that works.

Apply for an Emergency LoanEmergency Loan Definition

The amounts of emergency loans typically range from $100 to $3,000. Their purpose is to fund unexpected expenses quickly, so same-day or next-day funding needs to be an option. The characteristics of emergency loans are:

- Fast approval—often within minutes

- Same-day or next-business-day funding

- Accessible to borrowers with bad credit

- Minimal documentation required

Most importantly, emergency loans focus on your current income and ability to repay rather than past credit history. Traditional banks and credit unions may not offer this. Online lenders usually can because they have lower overhead and convenient technology.

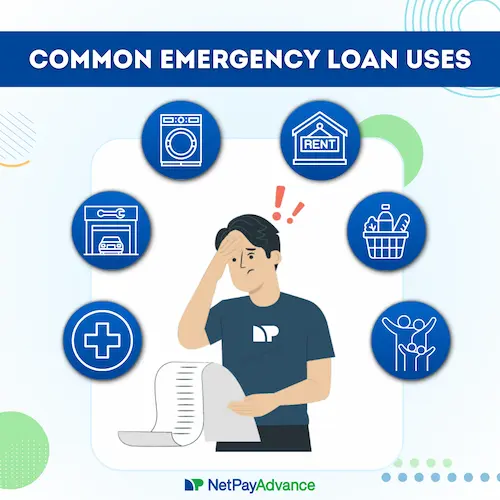

Common Emergency Loan Uses

Only you can decide what qualifies as an emergency, but there are a few urgent expenses that most people can’t cover with their cash on hand. These include:

- Medical emergencies and healthcare costs

- Car repairs needed to get to work

- Emergency home repairs (burst pipes, broken HVAC)

- Preventing eviction or utility shut-offs

- Unexpected family emergencies

You can also add food and essential household products to this list. They may not be emergency expenses for you, but many people in the United States are struggling with rising costs and limited resources. For them, food is an emergency expense. Payday loans and emergency loans are often used in these circumstances because of their accessibility, speed, and flexibility.

Read our full article on why Americans need emergency funds.

How Do Emergency Loans Work?

The emergency loan process is designed to meet the needs of individuals who require immediate cash and a straightforward application process. Those who can afford to wait for more traditional loans don’t have the same sense of urgency. Here’s how these two options differ:

- The application for an emergency loan is typically available online, takes five or ten minutes to complete, and doesn’t require extensive backup documentation. Emergency lenders typically request the bare minimum: basic personal information, employment details, and bank account information.

- Approvals occur quickly, often within a few seconds or minutes after the application is submitted. This is where advanced technology accelerates the process. The algorithms used for online loan approval typically identify income eligibility and assess an applicant’s ability to repay the loan. It uses a soft credit check to confirm identity, which isn’t visible to other lenders, and there’s no minimum credit score required.

- Applicants can (and should) review the loan terms before accepting. These terms include the exact loan amount, annual percentage rate (APR), fees, repayment schedule, and the total amount due. This data is also available from traditional lenders, but online lenders simplify it. Always work with a lender who is transparent about fees.

- Upon approval, applicants can receive their accepted funds the same day or the next day, depending on the lender. This is one of the defining characteristics of emergency loans. At Net Pay Advance, to qualify for same-day deposit, the borrower must have a valid debit card on file able to accept instant funding.*

- Repayment is automatic. The lender usually requires this to ensure they receive their funds back by the due date. Money is withdrawn directly from the borrower’s bank account on a schedule dictated by the loan terms. Payday loan repayments come out of the next paycheck. Longer-term loan payments are usually deducted monthly and aligned with the borrower’s pay days.

Emergency Loans vs. Payday Loans

These two descriptors are often used interchangeably. Emergency loans are any loans that can be used to cover an emergency expense. Payday loans fall in that category, as do installment loans and short-term cash advances. Your options are often dictated by the availability and cost of certain lending products in your home state.

Payday loans also come in several different forms. Tribal lenders and lenders based outside of the United States are not subject to state lending laws, so their fees and interest rates may be higher. Domestic direct lenders, like Net Pay Advance, are bound by state lending laws, so their fees are typically lower.

Net Pay Advance, a state-licensed direct lender in multiple states with over 8,000 customer reviews, offers emergency loans online with clear terms, no hidden fees, and full compliance with state lending laws. Contact us to learn more about how we do this.

Explore Emergency LoanPros and Cons of Emergency Loans

Advantages

- Same-day funding available

- Accessible with bad credit

- Simple online application

- Prevents worse consequences (eviction, repossession)

- No collateral required

Considerations

- Higher interest rates than traditional bank loans

- Short repayment terms require planning

- Additional fees if extended

Review your budget before applying for an emergency loan. The key to responsible borrowing is to ensure you have a clear repayment plan in place before accepting the loan.

Can You Get Emergency Loans with Bad Credit?

Traditional lenders rely heavily on credit scores and rarely approve applicants with scores under 670. A fair credit score of 580-669 is in a “gray area” for them, meaning many will ask for collateral. Individuals with poor or “bad” credit scores (under 580) are often told to look elsewhere. Thankfully, direct emergency lenders, like Net Pay Advance, often evaluate current income and repayment ability rather than relying solely on credit scores when reviewing emergency loan applications.

15.5% of Americans have bad credit, but still deserve to get credit. That’s where emergency loans can help. You can get emergency loans with bad credit. While banks focus on credit scores, direct emergency lenders look at your current financial situation. Do you have a job, gig work, or benefits? More importantly, can you afford to repay the loan? It’s a more holistic approach that provides loan opportunities to those who genuinely need them. Traditional banks and credit unions don’t look at it that way.

Another appealing feature of online emergency lenders is that they don’t do “hard credit checks” that impact your credit score. Instead, they use alternative verification methods or soft checks. This means applying won’t hurt your credit, and past bankruptcies, collections, or late payments won’t automatically disqualify you. That increases your chances of approval.

Flexible loan options available in licensed states.

Getting Emergency Loans Online

Why would you want to leave your home, stand in a long bank line, and likely get denied for a loan? You wouldn’t. Applying online is faster and more convenient. You won’t need to visit a bank branch, and you can apply for an emergency loan anytime, day or night. In the digital age we live in, there’s absolutely no reason to do it any other way.

That being said, there is a technique to improve your chances of getting your funds quickly with other online lenders. If you want same-day funding, apply early in the day, usually before 10 AM. Early morning applications could be processed, approved, and funded before the end of the business day. Every lender is different. At Net Pay Advance, though, we don’t have a cutoff time for same-day funding. Instead, customers who apply with a valid debit card may qualify for same-day funding*, regardless of the time of day or day of the week.

When comparing emergency loans online, focus on transparency and total cost. Reputable lenders clearly display all fees up front. Look at the total dollar amount you’ll repay, not just the APR. For example, short-term loans often include a small, flat fee that can vary by lender and state regulations. While the annualized APR may appear high, the actual cost for a brief borrowing period is typically modest.

Alternatives to Consider

Before taking an emergency loan, explore:

- Emergency savings if available

- Payment plans with service providers

- Borrowing from family or friends

- Community assistance programs

For some borrowers, they’ve determined an emergency loan is best for them, but they’re not sure which type of loan to consider.

Many borrowers needing emergency funds use online cash advance. A cash advance is any type of loan that is set up to be repaid based on your future paycheck(s) or income.

- That could be a loan like a payday loan where the full loan is paid back in one lump sum using a portion of the borrower’s next paycheck.

- Or, it could be an installment loan where repayments are made in smaller installments on a monthly basis, and often aligned with the borrower’s future paydays.

- Or it could be a line of credit account where borrowers can borrow funds from their credit line, and repay on their next payday or over several paydays.

Borrowing Responsibly

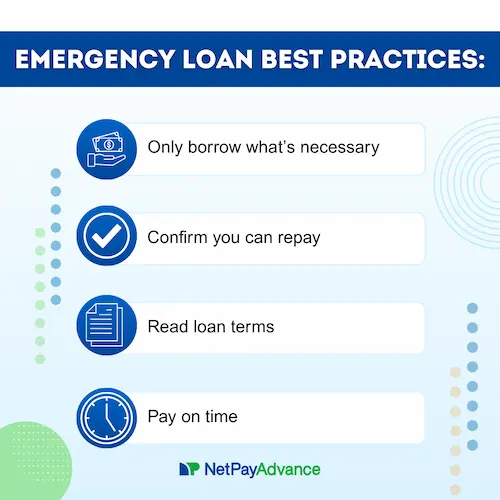

Follow these guidelines for responsible emergency borrowing:

- Borrow only what you need for the immediate emergency

- Confirm you can afford repayment before accepting

- Read all terms and understand the total costs

- Pay on time – avoid rollovers when possible

- Build emergency savings after repayment

When you’re able to, building an emergency savings is important. Beyond giving you emergency cash when you need it, an emergency loan also provides benefits like reducing financial anxiety, preventing overspending, catching up on expenses, and preventing making hasty financial decisions. Read more on why Americans need emergency funds.

Finding the Right Emergency Loan

Emergency loans offer crucial financial support when unexpected expenses arise and you need immediate cash. While they cost more than traditional bank loans, they offer accessibility, speed, and convenience that can prevent worse financial consequences during genuine emergencies.

The difference between a helpful emergency loan and a problematic one often comes down to the lender you choose. Licensed direct lenders operate transparently, comply with state regulations, and provide clear terms. They’re accountable to regulators and have established reputations to protect. Unlicensed lenders and offshore lenders may employ predatory practices.

Net Pay Advance offers emergency loans online with fast approval, same-day funding, and upfront pricing. With over 8,000 customer reviews, we provide emergency cash loans backed by transparency and regulatory compliance. When you’re facing a financial emergency, you need a lender you can trust.

Ready to apply? Visit our emergency loans page to get started with a simple online application and receive a decision in minutes.