- Net Pay Advance

- Tennessee Flex Loans

What is a flex loan?

A flex loan is also known as a “line of credit.” Draw from up to $3,000 and make convenient payments on your balance.

Is a Flex Loan Right for You?

Top benefits of flex loans:

- Same-day* loans when you need it most

- No collateral required; just apply online anytime

- Flexible repayment terms that fit your budget

- Bad credit loans available, get flex loans with no hard credit check

Keep in mind:

- Higher APR than loans designed for excellent credit

- Paying only the minimum can cost more over time

- Accounts close after 12 months of inactivity

At Net Pay Advance, we believe in transparency. We provide the facts so you can decide what’s right for you.

Flex loan vs. payday loan vs. personal loan

Many customers use a Tennessee flex loan as an alternative to payday loans because they’re both fast and convenient. Flex loans have the added benefit of a flexible credit line for ongoing needs. Take a look at these common Tennessee loans:

Net Pay Advance only offers flex loans in the state of Tennessee.

Cities in Tennessee we serve

Flex loans are always nearby.

![]() Memphis flex loans

Memphis flex loans

![]() Knoxville flex loans

Knoxville flex loans

![]() Chattanooga flex loans

Chattanooga flex loans

![]() Bristol flex loans

Bristol flex loans

![]() Knoxville flex loans

Knoxville flex loans

![]() Martin flex loans

Martin flex loans

![]() Shelbyville flex loans

Shelbyville flex loans

Why choose a direct lender for flex loans in Tennessee

Net Pay Advance is a direct lender for flex loans in Tennessee. That means we handle the entire process, so you don’t have to deal with any middlemen.

We protect your privacy

As a licensed lender, we adhere to strict security standards. We never sell your information. Indirect lenders often do.

Same day loans—easy process*

Instant decision on applications. Same-day* funding if approved with a valid debit card. Convenient repayment with online services.

Check if a loan provider is a state-licensed direct lender in two ways.

- See if they list the information on their website

- Call them for more information about their licenses

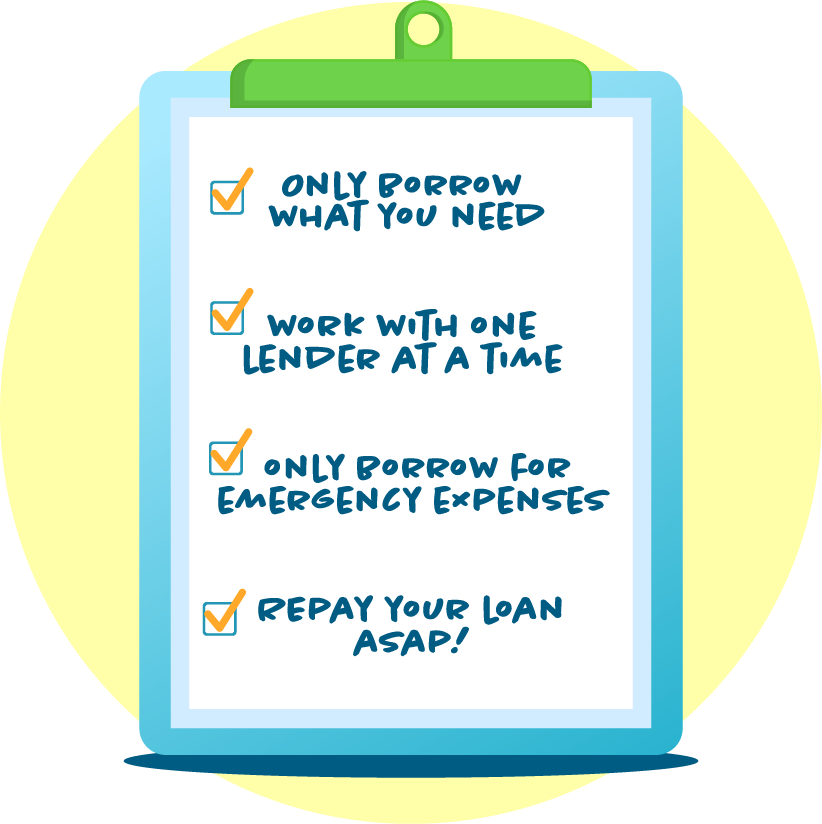

Best practices for using a flex loan responsibly

Each year, almost 24 million Americans choose to take out personal loans. Same-day loans* can be a quick solution for unexpected expenses. Nonetheless, it is important to be aware of best practices for your online loan to avoid debt.

• Borrow only the amount you need to cover an emergency expense.

• Work with one flex loan lender at a time.

• Use flex loans for emergency expenses only.

• Repay your credit line as soon as possible.

Repaying your online flex loan

Your loan should be as hassle-free as possible. If you cannot repay on time:

• Extend due date by up to 5 days (free).

• Use a Promise-to-Pay (PTP) plan (free), breaking repayment into smaller amounts.