Wondering how to get a loan with no credit? Read this!

Need a personal loan with no credit history? You’re not alone. And yes, it’s possible to get a loan regardless of your credit score, or even lack of credit score. Whether it’s for an emergency, a surprise bill, or something urgent, first-time personal loans with no credit history can help you cover life’s unexpected costs. In this article, we will answer questions related to first time personal loans no credit history along with tips to follow as a first-time borrower.

It’s common for people to need extra money sometimes. Whether it’s to cover an unexpected bill or to take care of an emergency expense, we all find ourselves in situations where we need a cash boost. In fact, 75% of Americans say that they’re not financially secure. The bottom line is you need money, be it $100 or $1,000. If you’re in a situation like this, don’t worry, because it’s more common than you think.

Never stress about an unexpected expense again.

Not having credit history can feel limiting at times. There are so many forms of credit that require credit history. Always remember that we all start somewhere! When it comes to applying for first-time loans, some lenders might require a credit history. Luckily for you, we don’t do that at Net Pay Advance. We are a trusted provider of loans for bad credit, low credit, or no credit at all! In this article we’ll talk about lending in general, not just our loan products.

Can you get a loan without credit history?

Yes! Many lenders still rely on credit scores, but at Net Pay Advance, we don’t. We focus on your ability to repay, not your credit score. That means you can qualify for on-the-spot loans with no hard credit checks (no hard inquiry, no impact on your credit). What this mean:

- No credit score required

- No credit score requirements

- No impact to your credit score for applying or taking out a loan

- Others won’t be able to see an inquiry on your report for applying or taking out a loan

- Quick online application

Pro tip: same-day funding is possible at Net Pay Advance. No every lender can boast that!*

Keep in mind: if you have bad credit, or no credit, applying for loans that require a hard credit check can come with risks. A hard inquiry may lower your score, and if you’re denied, it can make future approvals even harder. For those building or repairing credit, it’s often smarter to choose lending options that don’t penalize you for simply applying.

What is a personal loan?

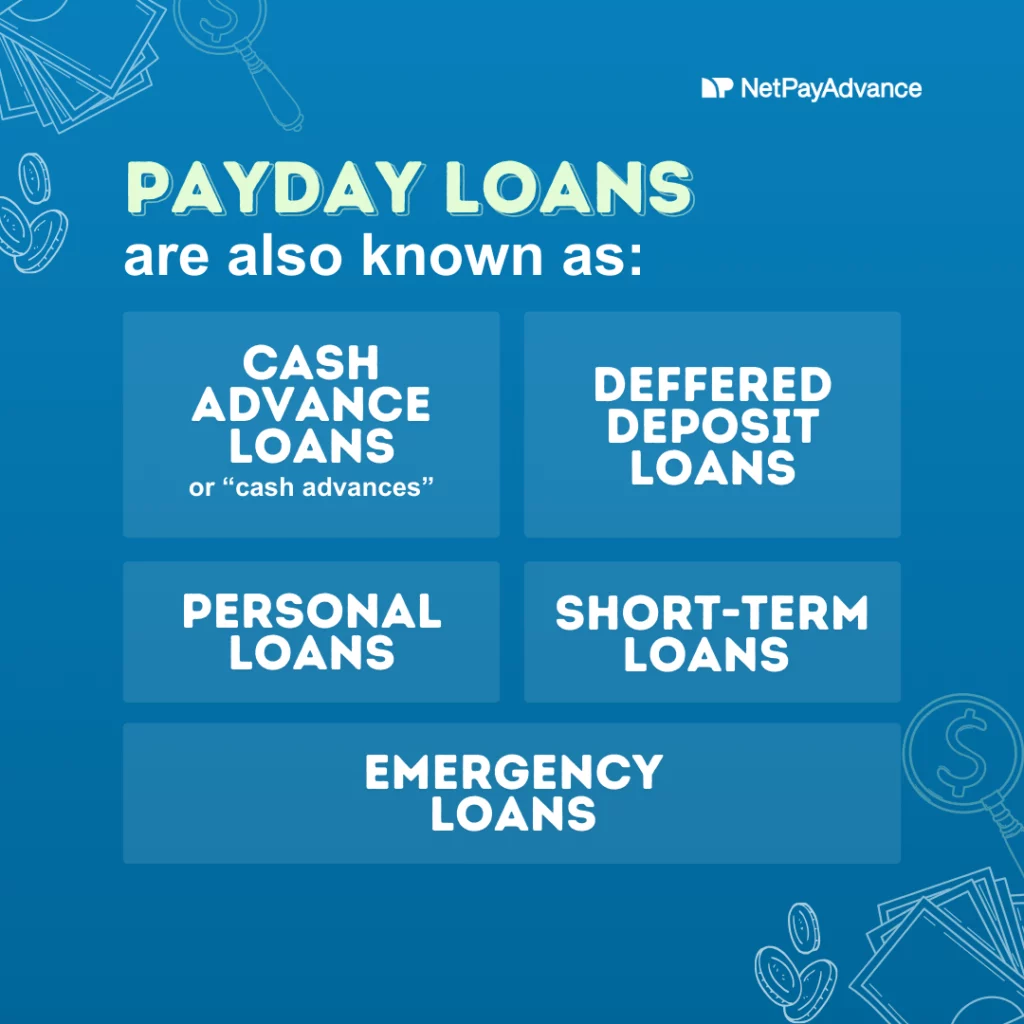

Personal loans (also known as payday loans, cash advances, or short-term loans) are unsecured loans, meaning no collateral is needed. They’re a fast, common solution for emergency expenses.

Take a look at some other common terms:

Personal loans are quite common. If you find yourself needing a personal loan, you’re certainly not alone. 23 million Americans have unsecured personal loans. “Unsecured” in the lending industry has nothing to do with the safety of the loan. In this case, “unsecured” just means that there’s no collateral backing up the loan, such as a home or car. It’s a term that relates more to the lender than to the borrower. Still an important term to know though.

Here’s a few other personal loan statistics you might want to know, including how many Americans use unsecured personal loans and how much money is borrowed, which generation has the most and least personal loans, what people use personal loans for, and where personal loans are being used.

Curious what borrowers use their loan for? Our recent study on what people use personal loans for has some insights. Check it out!

Why choose a personal loan with no credit history?

Sometimes, traditional credit isn’t available. If you’re new to credit or rebuilding, a personal loan with no credit history can:

- Help with emergency costs

- Offer flexible repayment depending on product

- Avoid the hassle of cosigners

- Provide access to cash fast, without judgement

Are no credit check loans real?

It’s possible to get a loan with no credit history or bad credit. However, no credit check loans are a bit of a myth. Transparency is important to us, so we’ll tell you what most lenders won’t: Net Pay Advance, and other lenders skip hard credit checks and use soft checks instead. Soft credit checks don’t affect your score. Instead, soft credit checks verify your identity and repayment ability, not your credit score. They’re quite common too! Many businesses will run a soft credit check on applicants. Even credit card companies will run a soft check withou permission to see if you qualify for certain credit card offers. Rest assured, other lenders won’t be able able to see it when they check your credit. Want more info? Learn more about soft credit checks in this article.

Do I need a cosigner?

No. With Net Pay Advance, you don’t need a cosigner. Our process is designed for first-time borrowers, even those with no credit.

5 tips for first-time borrowers

When choosing a first-time personal loan with no credit history, keep these in mind:

- Compare rates and terms

- Check all fees upfront

- Look for state-licensed lenders, this means they follow state regulations set to protect borrowers

- Net Pay Advance is state-licensed in all the states we operate

- Pick a repayment schedule that matches your payday

- Read lender reviews

- Net Pay Advance has 8,000+ positive reviews!

- Curious if we offer loans in your state? Select your state below

Final thoughts

Not having a credit history shouldn’t stop you from getting financial help. At Net Pay Advance, we offer on-the-spot loans with no credit checks, designed for first-time borrowers. No cosigner is required, there is no hard credit pull, and no hassle.

Take control of your finances today.

same-day loans.

same-day loans.