We surveyed our customers and found the most common reasons for a personal loan

Have you ever wondered how people use personal loans? We did! So, we asked. We surveyed over 100 of our customers and asked what they use their loan for and got some interesting answers.

This wasn’t a test, and there were no wrong answers. We just wanted to see how a personal loan helps people in their everyday lives.

The results show that personal loans can be helpful for many different needs. From keeping the lights on to keeping the car running. Some people used them for emergencies, others for everyday costs. And some used them for things they’d been putting off, like fixing a leaky roof or getting new brakes on the car.

The results showed us more than just numbers. They told us what matters most to our customers. Let’s take a closer look at what people said.

How consumers use their personal loan

Here’s what customers told us:

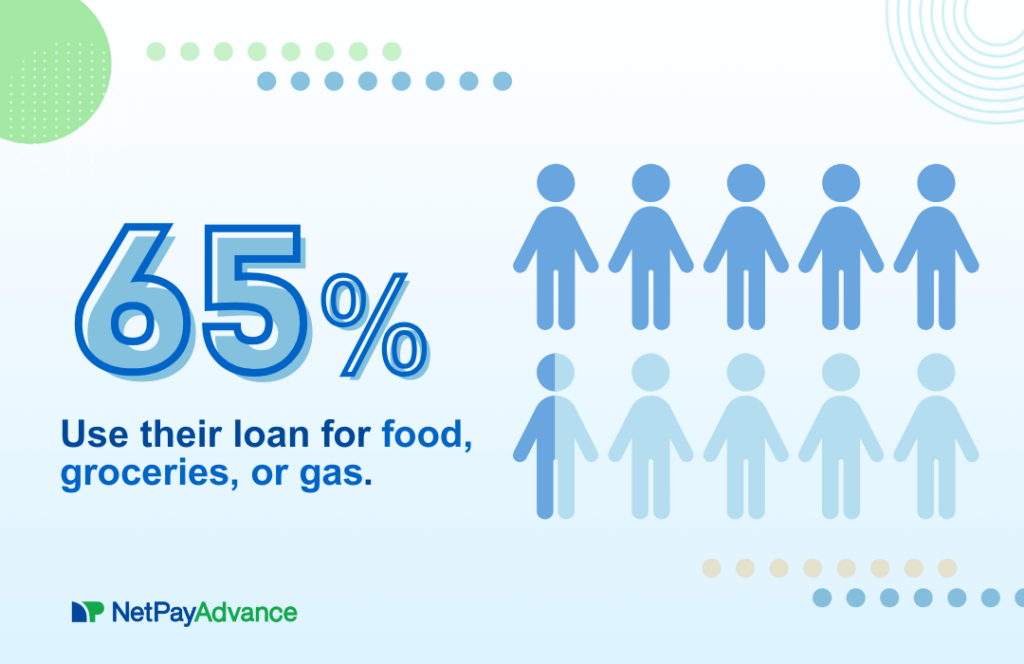

- 65.4% use their loan for food, groceries, or gas

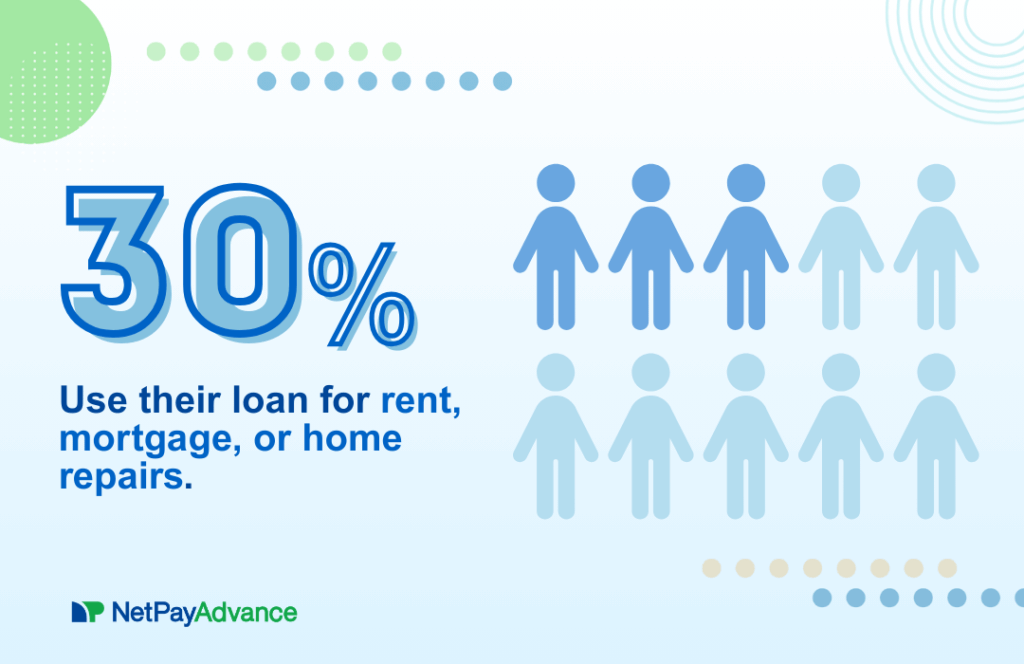

- 30.9% use their loan for rent, mortgage, or home repairs

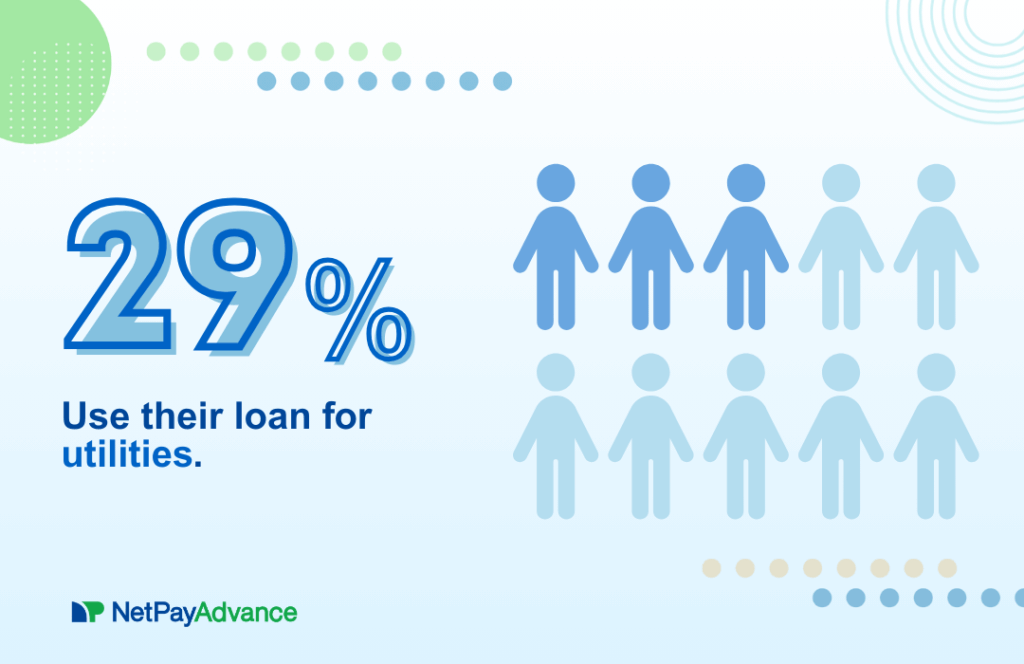

- 29.6% use their loan for utilities

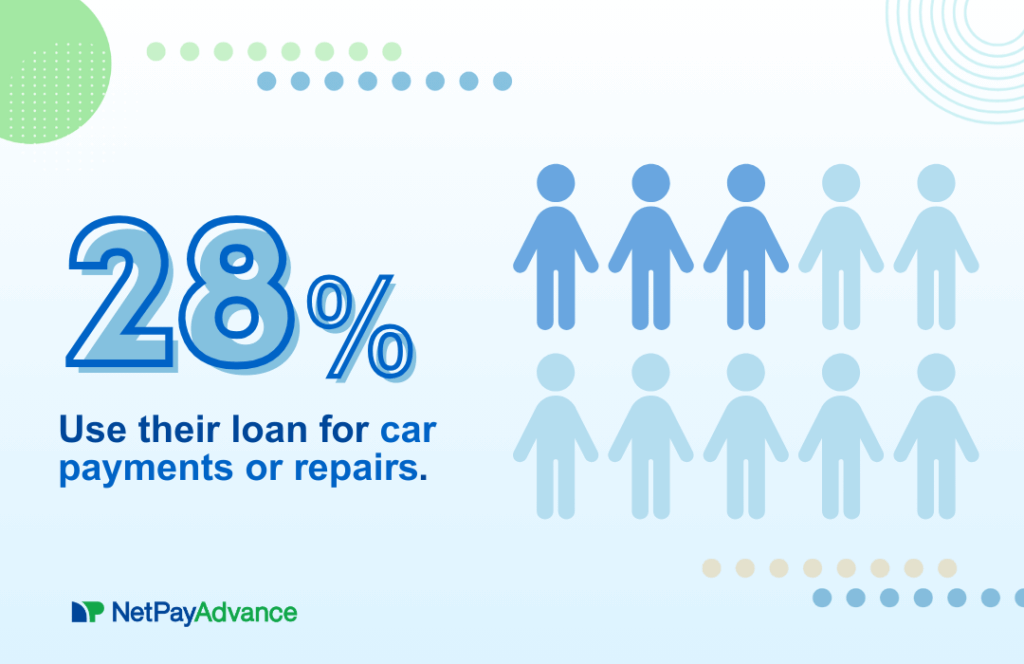

- 28.4% use their loan for car payments or repairs

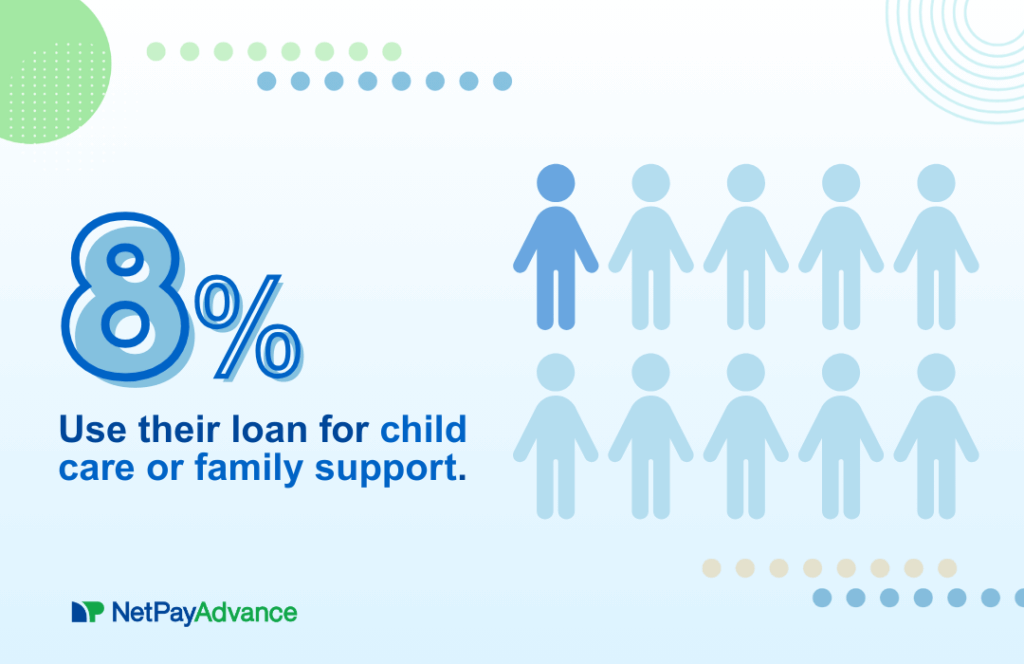

- 8.6% use their loan for childcare or family support

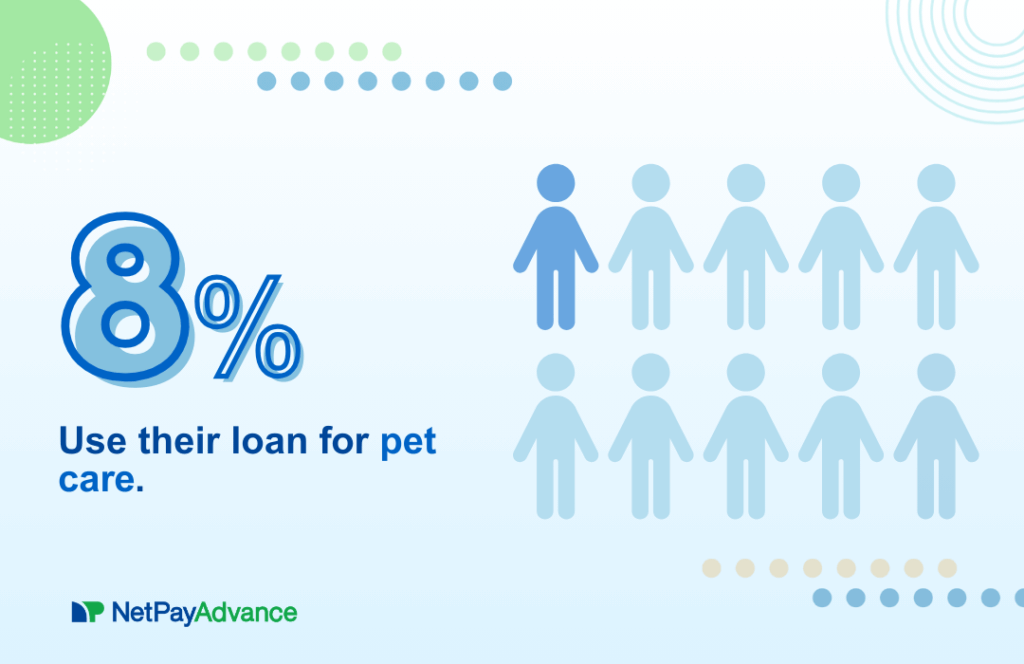

- 8.6% use their loan for pet care

The numbers do not add up to 100% because customers could choose multiple answers.

That means over half of customers used their loan for essentials like food and transportation. About a third either used it to a roof overhead, paying bills, or keeping their car. 18% used their loan to take care of a loved one.

Food, groceries, and gas: 65.4%

Life’s everyday essentials were the most common reason for getting a personal loan. 47 million Americans are food insecure, which means they don’t have consistent access to enough healthy food to feel full. Gas to get to work, groceries for the week, and other necessities don’t wait for payday. A personal loan helps cover the gap so people can keep life moving.

Rent, mortgage, and home repairs: 30.9%

Housing costs are often the biggest expense people have, and it’s a necessity. If something unexpected happens, like a sudden bill or fewer work hours, rent or mortgage payments are still due. When that happens, they can be hard to manage. But it’s important to keep a roof over your family’s head. Home repairs also can’t always wait. A leaking roof or broken heater needs fixing fast.

Utilities: 29.6%

Electricity, water, and heat are essentials, not extras. Our survey showed that customers often turn to a loan when they want to avoid service shut-offs and keep their home running smoothly. If you’re struggling to pay utility bills, you’re not alone. Read our article on resources to help cover utilities.

Car payments and repairs: 28.4%

Cars aren’t just about getting from point A to point B. They’re how people get to work, take kids to school, and run errands. Repairs or missed payments can cause major stress.

Worse, they can cause missed shifts, which then makes it hard to get funds to make the next payment! So, some customers use their loan to keep their car on the road.

Childcare or family support: 8.6%

39.47% of households in the United States have children under the age of 18. Every parent knows kids aren’t cheap, and 83% of parents with children under 5 said finding affordable childcare was a serious problem. Whether it’s paying for childcare while working or helping a family member with an urgent expense, these customers used their loan to take care of loved ones.

Pet care: 8.6%

Pets are part of the family too. From emergency vet visits to routine care, these customers made sure their pets got the help they needed. In fact, when it comes to reviews, we’ve received 20 reviews that specifically mention we were able to help a family cover a cost for their pet.

Which brings us to our next question: Why do customers choose us?

Why customers choose Net Pay Advance

Knowing what people spend their loan on is only half the story. We also wanted to know why customers pick us over other lenders or other financial options.

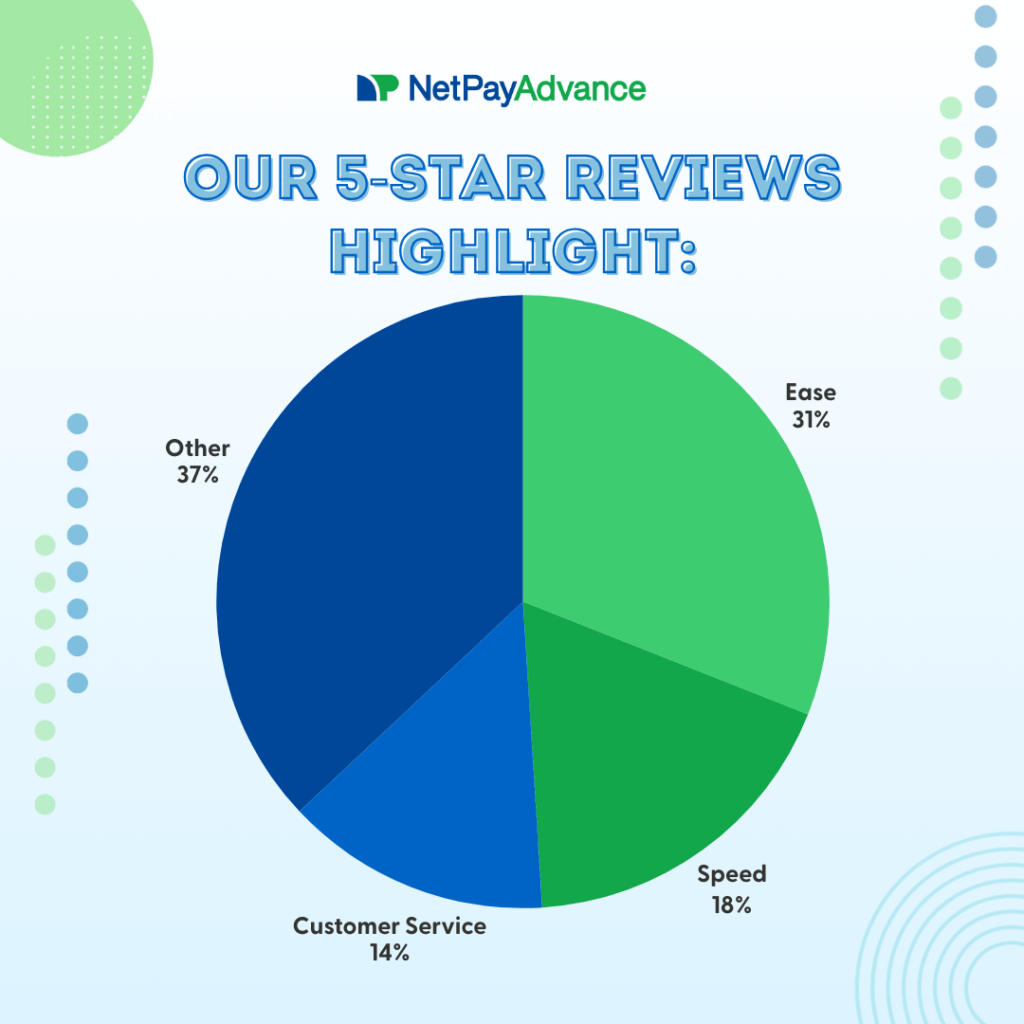

To find out, we read through 8,159 five-star reviews. We looked for words and phrases that came up frequently. This told us what customers really notice about our service.

Here’s what we found:

· Easy: 2,304 reviews mention how easy our loan services are (28%). We make the lending process easy.

· Fast: 1,373 reviews mention how fast our loan services are (17%). Our services are speedy.

· Friendly team: 786 reviews mention our friendly customer service team, or mention a person on our team helping them (10%). We have superb customer service.

· Best: 331 reviews mention we’re the best lender (4%). We have superb customer service.

· Online: 158 reviews mention they appreciate we’re an online lender (2%). We make the lending process easy.

· Happy: 145 reviews mention we made them feel happy (2%).

· Credit: 63 reviews mention we helped them even when they had bad credit or no credit (1%). We make the lending process easy.

· Instant or same day: 60 reviews mention that customers loved our same-day* funding feature for customers with a valid debit card on file (1%). Our services are speedy.

· Car: 49 reviews mention we were able to help them cover and expense relating to their car (1%).

· Family: 81 reviews mention we were able to help their family or kids (1%).

Honorable mentions: 20 reviews mentioned we helped their pet, 22 reviews mentioned we helped them keep or maintain their home or apartment, 48 reviews mentioned we helped them cover utilities or essential bills, and 15 reviews mentioned we were able to help them during the holidays.

When you add them up together, these reviews help show that Net Pay Advance customers love us because of ease (31%), speed (18%), and superb customer service (14%).

Ease of use (31%)

The word easy came up in twenty eight percent of reviews, the single most common compliment. Mentioning we’re online came up in two percent of reviews. An additional one percent of reviews imply we work with people regardless of credit. Customers appreciate that our application is simple, that they can do it online, and that getting their money is straightforward.

Speed matters (18%)

Seventeen percent of customers specifically said we’re fast. And an additional one percent mentioned our instant or same-day funding*. When people are stressed about paying a bill or covering an emergency, waiting days for money isn’t an option. Our process moves quickly, and customers notice.

Customer service (14%)

Ten percent of reviews mentioned our team or praised our customer service. And an additional four percent called us the best. This tells us that people remember not just the loan itself, but how they were treated along the way. It’s possible this percentage is larger as we could not search for individual employee names.

Flexible for different needs

While speed and ease were the most common praises, we also saw customers talking about our ability to help in different situations. A few reviews even mentioned holiday needs, pet care, and family expenses.

What this means

By combining our survey results with our review study, we learned a lot about both customer needs and customer priorities.

· People most often use a personal loan for essentials — food, gas, housing costs, and utilities.

· When they choose a lender, speed and ease are the top two things they value.

· Good customer service leaves a lasting impression, and people remember it enough to mention it in reviews.

The takeaway is a personal loan isn’t about buying extra “wants”. It’s often about covering urgent “needs.” Customers turn to us when time matters, the process needs to be simple, and they want to work with a team that treats them well.

By listening to customer feedback and tracking what matters most, we can keep improving our service. And that’s exactly what we are doing and plan to continue to do.