Discover what a hard money loan is and if you should get one

If you dabble in real estate and property investments, you’re likely to encounter the term “hard money loan.” Although it may sound like a loan where you get cold hard cash, there is more to a hard money loan. Keep reading!

Never stress about an unexpected expense again.

Most of us have taken out loans at some point in our lives. From a personal loan for emergency expenses to car loans or even student loans, there is a wide range of loan options available to us. In short, we take out a loan when we need money for a purpose and with the promise or intention to repay the loan later. In this article, we will try to answer these questions:

- What is a hard money loan?

- How does a hard money loan work?

- Should I get a hard money loan?

Let’s get to the nitty-gritty of everything that encompasses such loans.

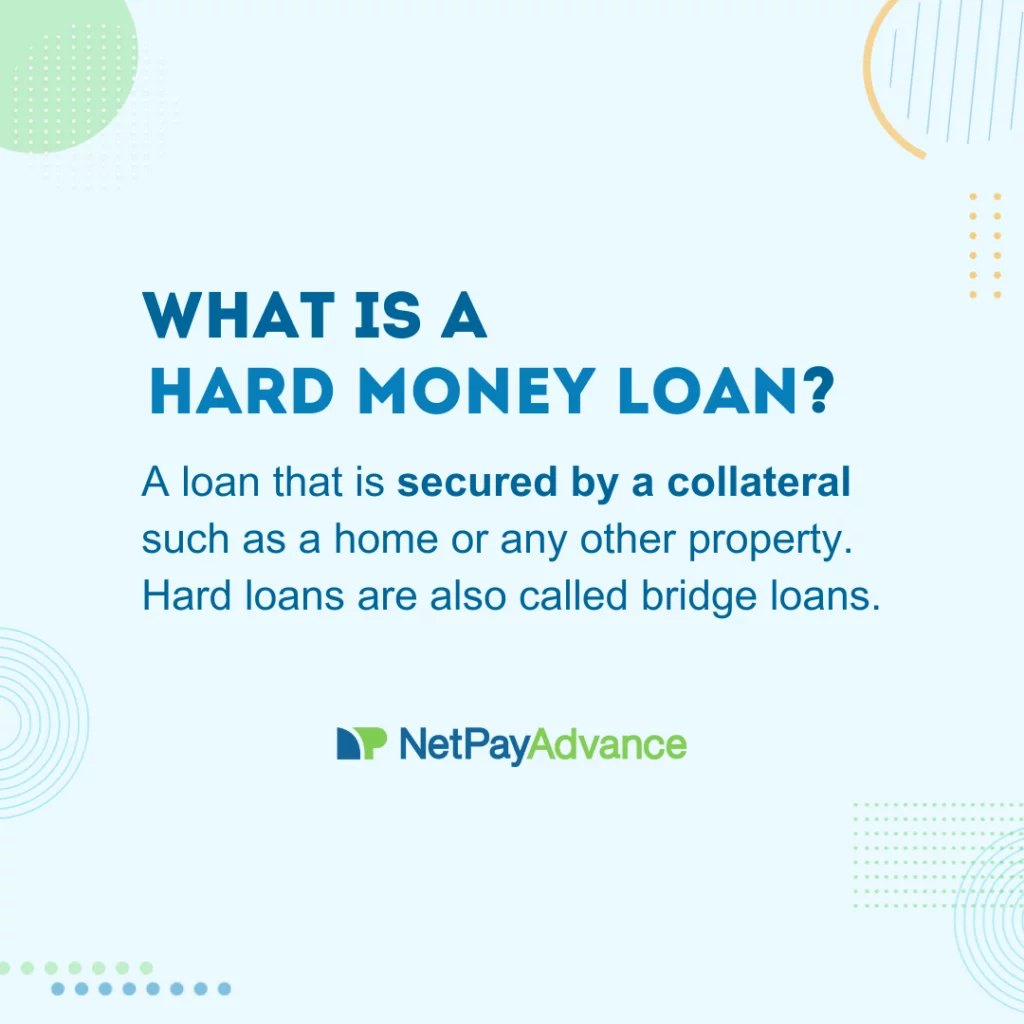

What is a hard money loan?

A hard money loan is a loan that is backed or secured by collateral. This collateral can be a home or any other property or asset. A hard money loan is also known as a bridge loan. This is because the purpose of a hard money loan is to build a path or bridge to achieving sale of a property.

Unlike a traditional loan where a borrower’s credit history impacts approval or denial, a hard money loan considers the value of collateral when approving or denying a loan.

It is important to note that a hard money loan is a short-term loan and is usually used for flipping houses, buying investment properties, or purchasing commercial properties. They are best suited for situations where you need money quickly to fund a project or venture and are confident in getting back sufficient money to repay the loan in time. Generally, you can’t get a hard money loan from a bank or a credit union but will need to seek out hard money lenders or companies that do such loans.

How does a hard money loan work?

The entire process of taking out a hard money loan is fairly simple and can be explained in the following steps:

- Borrowers identify hard money lenders and choose one they want to work with. This can happen through online research or referrals from other borrowers or professionals in the real estate industry.

- They approach hard money lenders with proposals to get approved for a hard money loan.

- The borrowers offer proof of collateral which is a house or property.

- Hard money lenders evaluate property value and estimate its worth. They do not focus on a borrower’s financial standing or credit history.

- The terms for a hard money loan can be discussed and negotiated between both parties.

- If the property value and potential investment opportunity seem favorable to hard money lenders, they will approve the loan and release the funds. Note that hard money lenders will usually lend 65%-75% of a property’s current value.

- Borrowers are required to repay the loan within a few months to a few years unlike traditional mortgages that run for up to 30 years.

- Borrowers stand the risk of losing the collateral if they fail to repay hard money lenders.

Pros and Cons of a hard money loan

Like most things in life, a hard money loan comes with its own set of pros and cons. It is essential to scan through these when deciding whether to take out a hard money loan or not. Let’s explore these attributes:

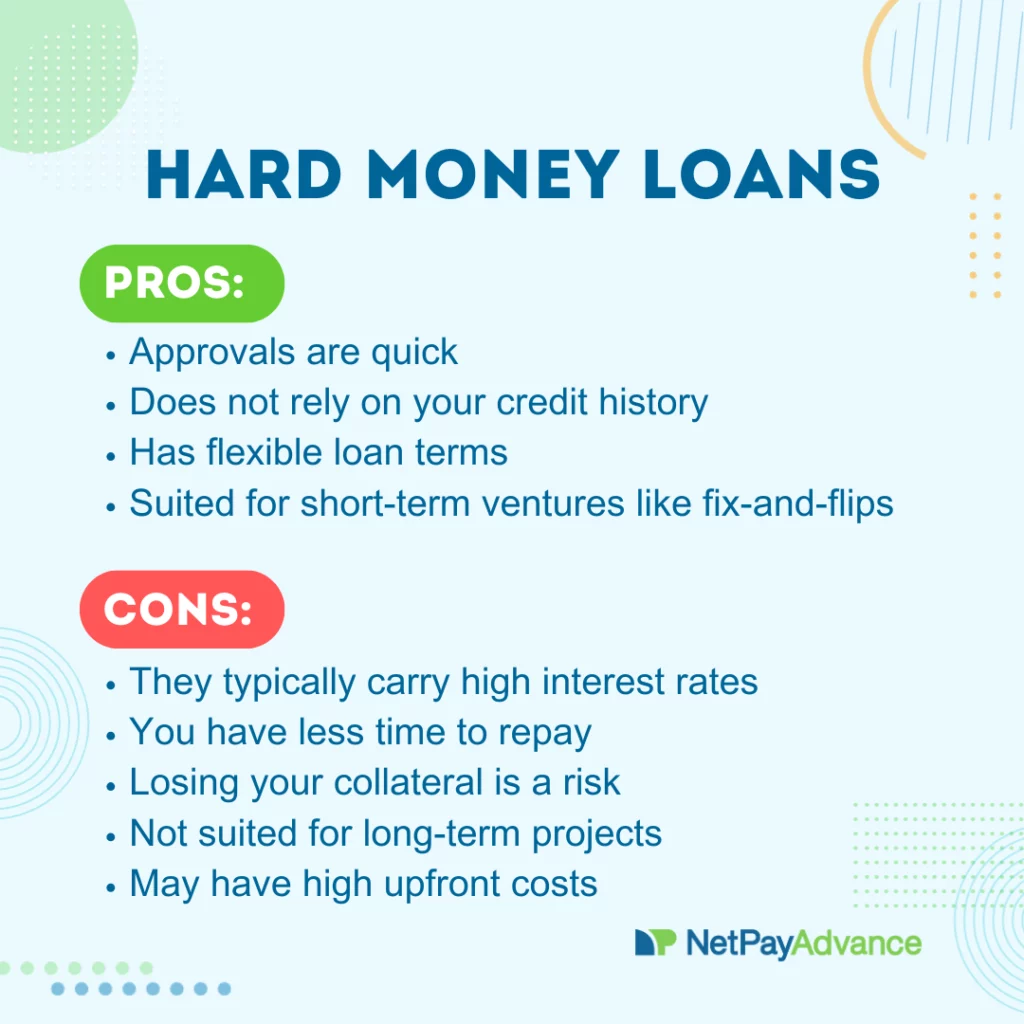

Pros of a hard money loan:

We tend to focus on the good in everything and that’s why we list the selling points of a hard money loan first. The pros of a hard money loan are:

1. Quick approvals

The process is simple and fast. Hard money lenders don’t have to determine if a customer can repay a loan before approving them for the same. The value of collateral is considered instead of spending time assessing the borrower’s finances and income.

2. No reliance on credit history

You can get a hard money loan regardless of your credit, if you have the collateral needed to take out such a loan. This makes it easier for people with less than stellar credit to have a fair shot at getting approved.

3. Flexible loan terms

Hard money lenders usually offer flexible loan terms and conditions compared to traditional lenders. For instance, they may have flexible LTV (loan-to-value) ratios and repayment schedules.

4. Suited for short-term ventures like fix-and-flips

Quick projects where the goal is to make money by selling a property you just made improvements on, are where a hard money loan comes in handy. Fix-and-flips make the perfect example for this.

5. Potentially no prepayment penalties

Although some hard money lenders have different policies, some will issue you a hard loan where you don’t get penalized for paying off a loan ahead of time. Make sure to double-check with hard money lenders regarding their prepayment penalties if any.

Cons of a hard money loan:

We are realistic and understand that most things come with a drawback or two. In the spirit of transparency, we present the not-so-great attributes of a hard money loan:

1. High interest rates

It is no secret that a hard money loan will likely have a higher interest loan than a traditional loan. In fact, on average a hard money loan has an interest rate of 10% to 18%. This is higher than what a conventional mortgage will carry as interest rate. Unless you are comfortable with high interest rates, maybe a hard money loan isn’t for you.

2. Shorter repayment period

A hard money loan is a short-term loan. Therefore, such a loan has a shorter repayment period. As a borrower you must be aware of this and have a plan in place to repay the loan.

3. Higher risk of losing collateral

Probably the biggest con of all is the fact that you could potentially lose your collateral if you fail to repay this loan. This makes a hard money loan riskier than other loan options.

4. Not suited for long-term projects

Short-term loans are never suited for longer timelines. That’s why a hard money loan is suited only when you know you’ll be done with your project soon enough to repay the loan in time.

5. May have high upfront costs

This includes an origination fee, processing fees, service fees etc. Always ask hard money lenders about all fees associated with your hard money loan at the start.

What are the alternatives to a hard money loan?

Don’t we all love options? Let’s say you don’t want a traditional loan, but you’re also apprehensive about getting a hard money loan. In such situations, you would like to have alternative options you can consider. Luckily, there are a few alternatives to taking out a hard money loan and they are:

Home equity loans: A home equity loan is one where you finance a property by taking out a loan against a home or property that you already own. Such loans get approved based on the value of the property you own and how much equity you have in it. Home equity loans usually have lower interest rates compared to a hard money loan.

Family loans: A loan from friends or family members can be described as a private loan. We understand that it could be awkward and uncomfortable for many of us to borrow from loved ones. However, some of us might have that level of comfort with their family and friends and so, it could be a viable option for them.

FHA loans: Federal Housing Administration (FHA) loans are more forgiving of prior financial mishaps like bankruptcy and have lower requirements to get approval. When borrowers don’t fulfil requirements for a traditional loan, an FHA could be just the solution they need.

VA loans: Available only to qualified veterans, active-duty members, and their spouses, loans issued by the Department of Veterans’ Affairs have lower approval requirements, no down payment, and lower interest rates.

HomeStyle loans: These are government-backed mortgages that allow borrowers to renovate their homes and properties.

Payday loans: Sometimes all you need is a small boost to make it till your next payday. Depending on your state of residence, you might be able to borrow a decent amount of money as a personal loan and take care of expenses. Also, like a hard money loan, your credit doesn’t matter when you work with a payday lender like us. At Net Pay Advance, we offer poor or bad credit loans. In some cases, you could even take out a line of credit loan, which will offer added flexibility as you can use such a loan like a credit card. Find out if a personal loan or a line of credit would work for you.

Should I get a hard money loan?

You may have asked yourself if you should take out a hard money loan. The answer depends on what your goals are and the practicality of the situation. Ultimately, you know your situation best.

A hard money loan is often used by real estate developers and investors when they don’t want to get a traditional loan. These loans offer quick funds and flexibility but come at higher interest rates and require collateral. We hope this article will help you make an informed choice.

For personal loans and same-day loans with instant funding*, give us a shot. help people like you every day looking for solutions to urgent expenses. Just fill out our quick online loans application and you’ll have an instant decision!

same-day loans.

same-day loans.