If you’re like me, the first few months of a new year are always a blur. Maybe it’s the post-Holiday coma my social life and bank account go through or just getting settled into a new year? Either way, spring is always a welcome surprise. Since this is the season for “renewal” it’s also a great time to look at your finances and develop a strategic plan for the remainder of the year.

Is one of your goals this year to improve your credit score? The first step to achieving this goal would be to review your credit report. Did you know that you are allowed one free credit report from each credit bureau per year? You can download your annual report at www.annualcreditreport.com. (Pro tip: download your report from one bureau at a time so you can pull your full report for free more than once a year).

So, you’ve downloaded your report and you’re ready to start working on your score when you realize, “I don’t even understand all the information on my report.” Let’s break it down for you.

Personal information

Here you will find information about, well, you. Your name, social security number, date of birth, employment data, current address and previous addresses. While this section is self-explanatory, make sure you’re reviewing everything to confirm the information is correct.

Public record information

For those that have any pending or open legal issues that influence your financial situation, you would find information for those here. These include, but are not limited to; bankruptcies, foreclosures, liens, judgments, and wage garnishments. Some credit reports also include a date when those will be removed from your credit, which can be helpful.

Creditor information

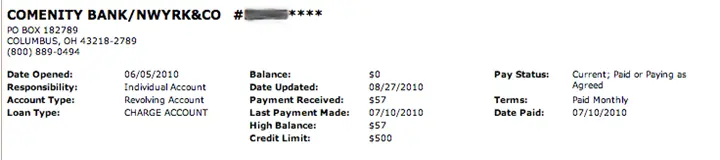

Each open account will show the status of the account, joint or individual responsibility, account balance, recent payment, past due information (if applicable), payment history, and the credit limit.

This section is the most important part of the credit report. Here, you can see all the existing lines of credit that are in your name. While each account will have different information, they should all look very similar to the image below.

Typically, accounts that are in good standing will be grouped together and any accounts that are not in good standing (adverse) will be grouped together as well.

What are adverse accounts on your credit report?

Adverse accounts are lines of credit that are delinquent, in collections, and/or have poor payment history. Any combination of these three factors will have a negative affect on your credit score making them “adverse”. If you have accounts in this section, you need to review them very carefully.

All three credit bureaus will allow you to dispute any information that is not correct. If the account is truly adverse, the information will fall off after seven years. As with the public record information above, some reports tell you the date it will be taken off your report.

Credit terminology

Charge-off

Essentially this means that the creditor has given off receiving payment from the borrower and have recorded the remaining balance as a loss. This happens after a long series of missed payments and the past-due balance has been undergoing collection activity. Unfortunately, even if you pay off the balance, once an account shows as a “charge-off” on your credit report, it will stay there until the adverse account falls off.

Revolving account

This is a type of credit account, typically a credit card. Revolving account means that the borrower is not required to pay the balance in full every payment.

Installment account

Another type of credit account. Most often, installment accounts are loans of some sort. Each installment account has a set payment amount that is fixed and paid over a fixed period of time.

Open account

While these are not commonly shown on credit reports, this is a type of account that is required to be paid in full each month. Most often, these are for utility companies like gas, water, or electric companies.

Collection amount

Accounts that are delinquent and have been sent to a third-party collection agency show on your credit report as a “collection account.”

Creditor Inquiries

This section of your report breaks down the number of “hard” and “soft” inquiries to your credit. What’s the difference? A hard credit pull happens when you’re applying for an auto loan or a credit card. These are necessary in the application process of many different types of purchases; however, it’s important to remember that hard inquires do affect your score and it’s best to keep them at a minimum. Soft inquiries are what happens when you check your own credit report or you’re pre-approved for a line of credit.

For more information on building your credit score review our blog article, https://netpayadvance.com/Understanding_and_Improving_Your_Credit_Score