The pros and cons, and what works best for you

Comparing online banking vs traditional banking is a new problem. It’s really only a question that consumers started to face in the21st century. What do we do when what’s conventional isn’t the only choice? Let’s dive in.

There’s a new player in town, and it’s all about convenience. We are a generation raised on traditional banking. The shift to virtual was only a matter of time, but are we ready for it? Is it truly a better alternative?

When it comes to your money, you’re the boss. You get to pick what type of financial institution you want to put your money in. We have previously addressed topics like:

In this piece, we will attempt to break down the pros and cons of online banking and traditional banking.

Choosing a bank is a huge financial decision. We’re here to shed light on the workings of traditional and online banks. Banks in either category aim to keep your money safe. Although their primary goals align, they differ in their processes, operations, and abilities.

It all comes down to what your needs are, and what you want in a bank. Some people seek the ease and convenience of online transactions. There are others who like the human interaction at a bank or credit union. Many of us are hesitant to try something we haven’t in the past. And then there are those that have no preference but want the most for their money. We can all make choices based on our likes and dislikes, and how we want things to be.

Online and traditional banking each have their upsides and downsides. We can’t say that one is better than the other. But we can assure you that one type will serve you better than its counterpart depending on what you need.

Picking one over the other might sound like a Herculean task. But it shouldn’t intimidate you, especially since you’re reading this. We did our research to help you make the right decision for your finances.

We know that online and traditional banks have differences. These differences are regarding their attributes and functions. You only have a few key points to consider before choosing one. And once you’ve considered all the factors, you’ll have a clearer picture of what works for you.

Should I pick online banking or traditional banking?

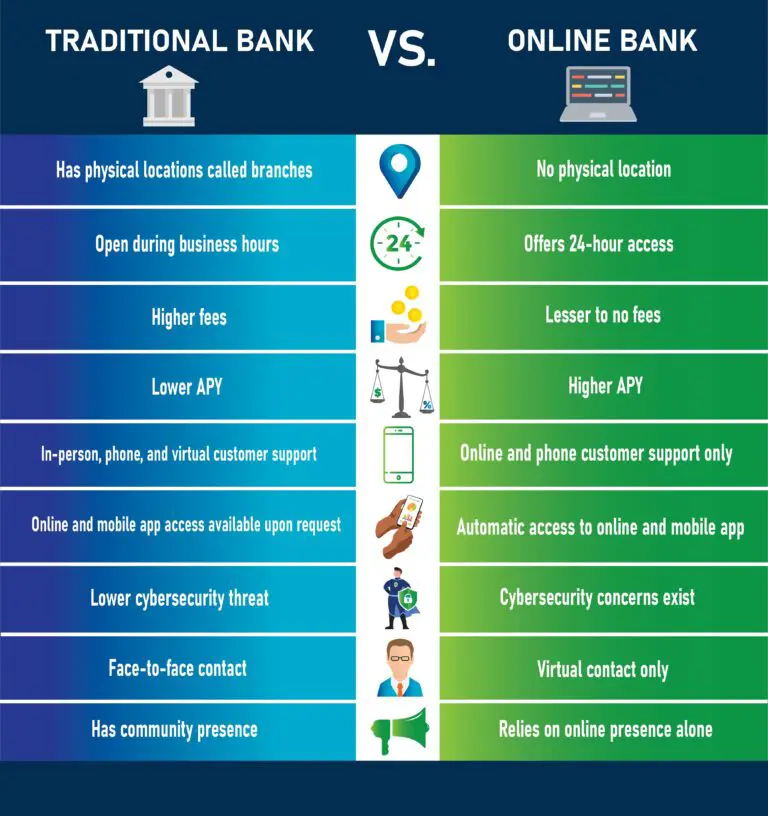

Listed below are some attributes of banks and how they differ in online and traditional banks:

1. Physical location

Most of us have visited a bank or credit union at some point in our lives. It might have been to make a withdrawal or to apply for a loan. Some of us might have dropped by to get our married name updated. There could be so many different reasons why we’ve found ourselves in a physical bank with people working there. We’ve all interacted with a teller or a loan officer, depending on our requirements that day. These are banks as we’ve always known them, aka traditional banks.

Online banks are the total opposite of traditional banks when compared on location. They do not have a physical presence in the form of a building. They are entirely virtual, and all their transactions are online. The only way you can contact them is by phone, email, or through their app.

2. Availability

Traditional banks operate during business hours. You might still be able to make transactions online as most offer online banking services and a mobile app. But you might have to wait till the next business day for other services.

Online banks are available 24/7. You can avail most of their services at any time you want. This makes online banking more convenient regarding accessibility.

3. Fees

Traditional banking involves several types of fees. You might be charged for just having a checking account with them. This is where online banks shine! They have very few fees that often amount to almost nothing. Traditional banks have a lower annual percentage yield (APY), which means you receive a very small interest on saving accounts. Online banks offer higher APY, and this gets the customer more interest on their savings.

4. Customer support

While you have customer support in both types of banking, they each work a little differently. Traditional banks have phone and in-person services with some online support available. Online banks have zero face-to-face interaction with their customers. All their support options are online with some phone support.

5. Mobile app

Most traditional banks today have online and mobile banking. However, these are treated as an add-on. They are usually available upon request.

In online banking, apps are an integral tool in conducting transactions. Customers are usually prompted to download the app when they sign up.

6. Cybersecurity

When an establishment is entirely online, cybersecurity issues and threats come with the territory. Online banks are targeted more than traditional banks. Therefore, they have superior protection plans in place to avoid data or security breach. Traditional banks have limited online activity and thus they have lower cybersecurity risks.

7. Community presence

Traditional banks and credit unions are considered members of the community. There are banks that have existed for decades and are part of a town’s history. Most of them host, sponsor, and participate in local events. They often contribute to local causes and are active in the community. Some offer scholarships to students from time to time. Their involvement with the people in an area weaves them into the cultural fabric of the place. Their customers are usually very loyal and have banked with them for generations. Online banks are relatively new and since they do not have local ties to a geographical area, they might not have a strong community presence.

Compare traditional banking vs online banking

The chart below lists out the different attributes of online and traditional banking:

As always, we try to bring you the most relevant information. We hope we were able to explain the differences between the two types of banking.

Keep in mind that some banks may offer both traditional and digital bank services. You can also have bank accounts with separate banks. It just depends on what your needs are. There’s about 57 million mobile banking users in the US, and not all of them are with digital-only banks.

Money and finances are extremely important in life. Depending on which you choose, online and traditional banking each have their own benefits. For instance, traditional banks have branches and several ATMs while online banks may have limited ATM access. You might also have to pay an extra charge and stay under cash limits.

Some features of online banking might appeal to you and make you gravitate towards it. Or you might like to stick to something offered by a traditional bank. Your choice needs to be based on what’s best for you.