Do you know how to endorse a check? Let us break it down for you.

Millions of Americans use checks every year. Even in the age of cashless payments, checks remain a popular mode of payment and will be around for the foreseeable future. That is why you need to know how to endorse a check. In this article you’ll learn how to endorse a check for yourself, how to endorse a check to someone else, and several other ways to endorse checks.

Did you know that over 60% of retail payments are made out by checks? That’s only retail! There are scores of other areas where checks come in use. So, before you call checks antiquated and old-timey (Gen Z, we’re looking at you!), let us assure you that checks aren’t disappearing any time soon and you might as well brush up on how to endorse a check.

You might need to cash a check someday even if you don’t use checks on a regular basis. Not sure how to endorse a check or how to endorse a check to someone else? You’re not alone. That’s why we’ve created our Checks 101 series.

- It is a good idea to know how to cash a check.

- Similarly, knowing how to void a check could also come in handy.

Now, let’s go ahead and find out what it means to endorse check, how to endorse as check, and how to endorse a check to someone else.

What does endorsing a check mean?

In simple terms, endorsing checks is where the recipient signs their name on the back of the check.

When someone pays you with a check, you will likely either want to deposit it into your account or cash it. (Although, there are other options we’ll touch on later in this article – including how to endorse a check to someone else). To do so, you will need to endorse the check. This authorizes the bank to convert the check to funds or cash.

Endorsing a check helps the bank verify a person as the recipient and authorizes the transaction. The transaction is then wrapped up and the recipient of the check gets the money. That’s why it is vital to know how to endorse a check properly.

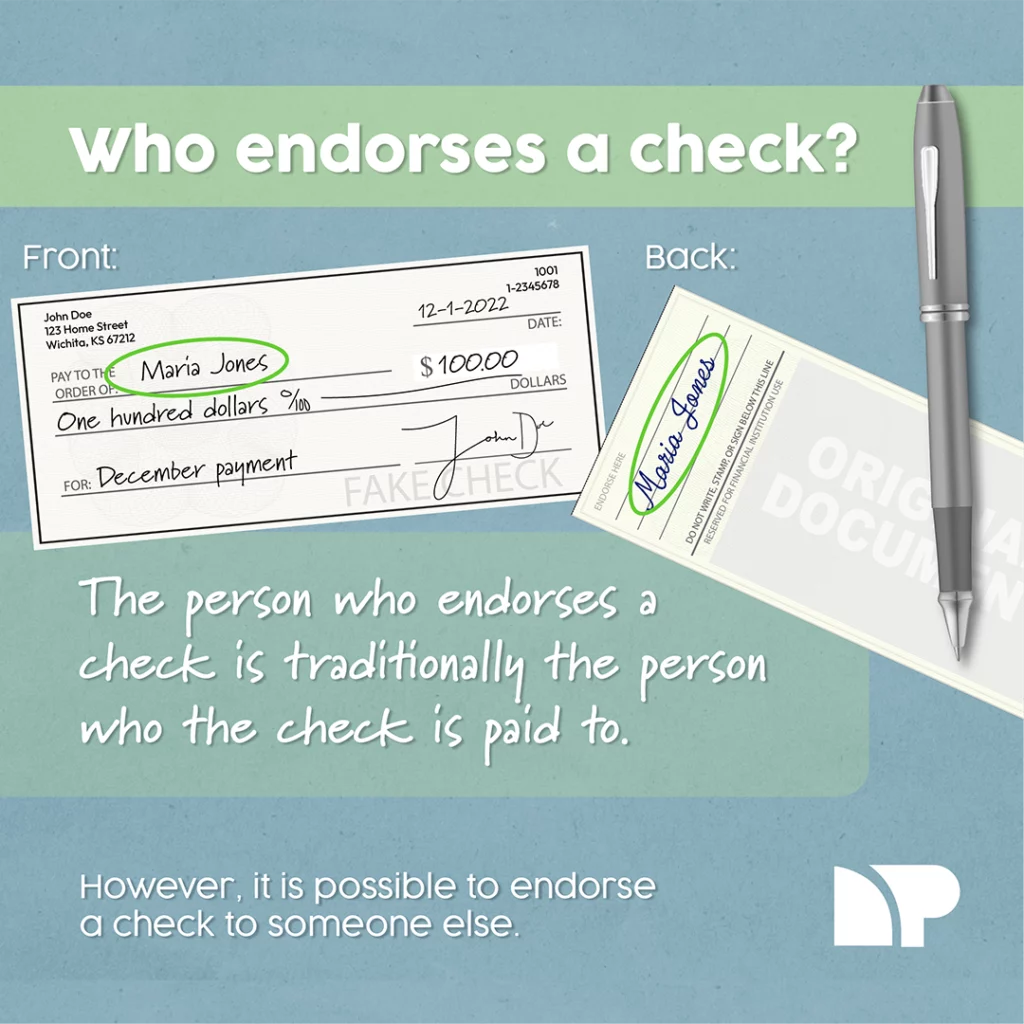

Who endorses a check?

The receiver is the person who endorses a check. You can always look at the “pay to order of” section of a check to find out who is supposed to endorse check.

Why do we need to endorse the check?

There are a few reasons why we must endorse a check. We have listed them for you.

- Check completion: When someone pays you with a check, your last step will be to sign it before depositing or cashing it.

- Mandatory signature: The receiver must sign the check in order for the bank to authorize the transaction.

- Easy endorsement: If you receive a check and want someone else to be able to cash it instead, this is one effortless way to do so. This could happen for a number of reasons:

- Transferring money to a third party: This is also known as special checks.

- Correcting information: The check was mistakenly put under your name but belongs to someone else.

- Preventing fraud: It helps prevent misuse if the check gets lost. If you’re paying someone and want to prevent fraud, you can clarify who should be depositing the check. You can also add restrictions to ensure the check is used as intended.

Ways to endorse a check

There are several ways to endorse checks. These are the three most common:

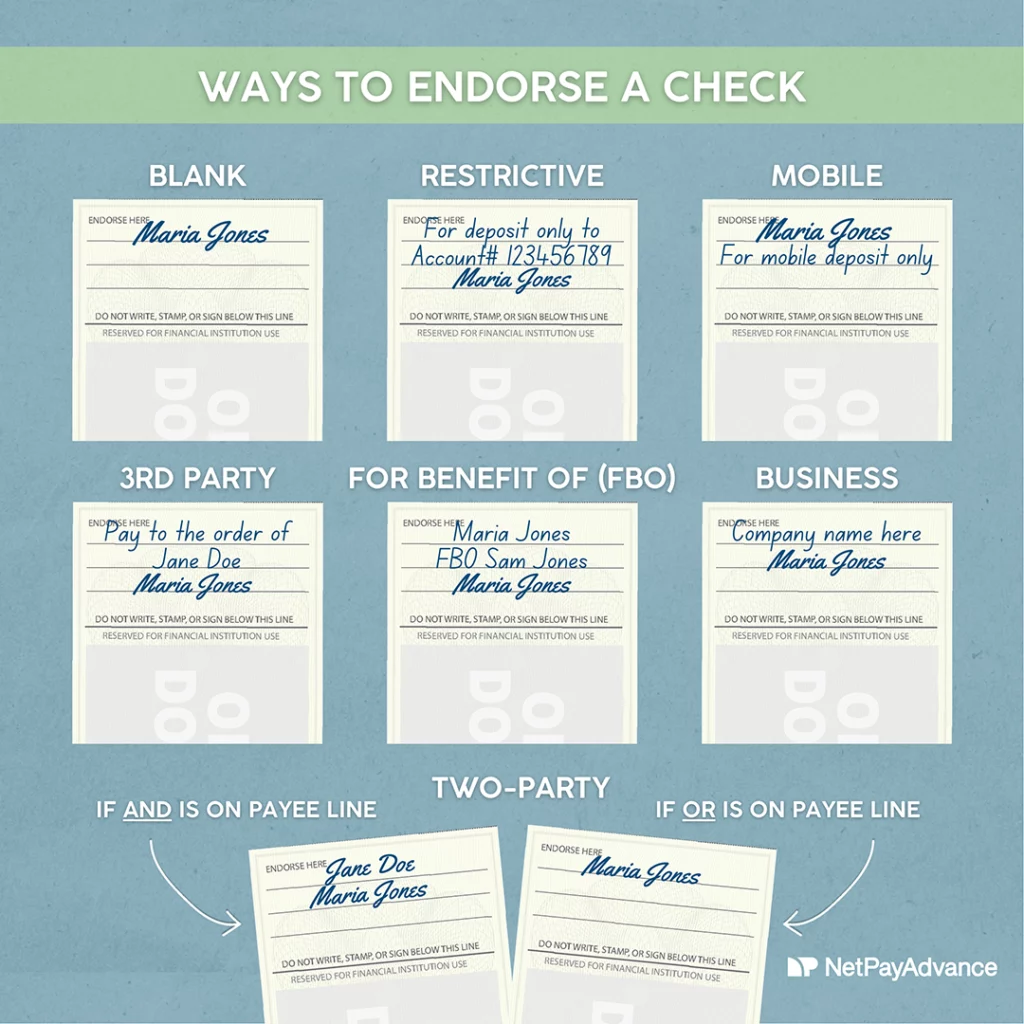

1. Blank endorsement

Blank endorsement is when you sign the endorsement area on the back of the check with no restrictions. Checks with a blank endorsement can be deposited by anyone regardless of whether their name is written on the check. You can endorse check in this manner for immediate deposits.

2. Special endorsement or 3rd party endorsement

To endorse check this way, the payer writes down the words, “Pay to the order of” along with the payee’s name.

Usually, banks will not cash these types of checks without the payee being present. This is done as a measure of fraud protection.

3. Restrictive endorsement

You can endorse check in this method by the payee adding a “restriction” in the endorsement area of the check. This is done to minimize the chances of theft if the check gets misplaced or stolen.

Common “restrictions” are added by writing “for deposit only” or “for deposit only to account” or “for mobile deposit only”.

Why is it important to endorse the check correctly?

Failing to endorse check correctly will cancel or stop the transaction. If done incorrectly, the check will be voided. It is advised to be careful when endorsing check to avoid delays in payment and other hassles. That’s why you must know how to endorse a check correctly and how to endorse a check to someone else.

How to endorse the check – Step by step

We have compiled all the steps you need to take to endorse a check. Let’s take a look!

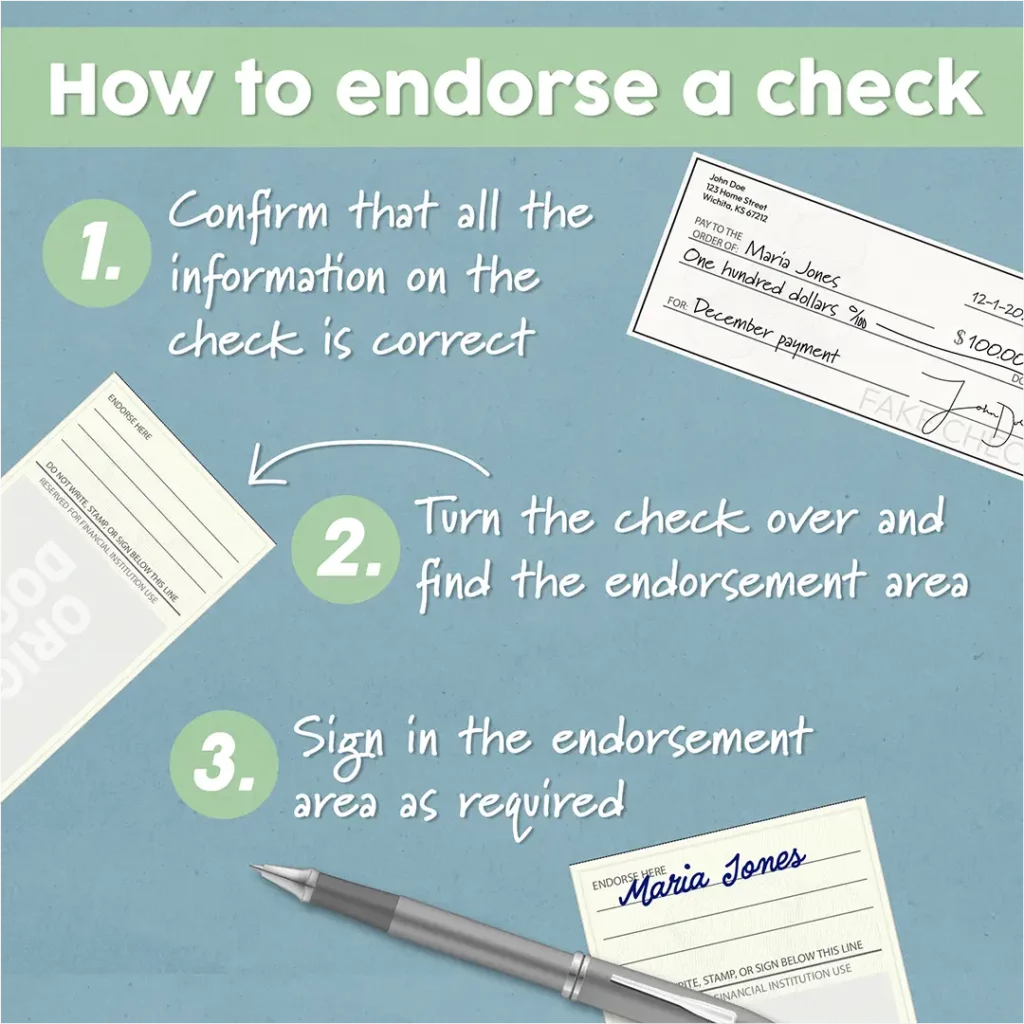

1. Confirm that all the information on the check is correct

Before you endorse check, we suggest double-checking all the information written on it. Make sure that the payee’s name is spelled correctly, the amount is accurate, and that the payer has signed the check.

2. Turn the check over and find the endorsement area

This is pretty simple. On the back of every check is a boxed space known as the endorsement area. You might see the words “Endorse here” and an arrow sign pointing to this area. Typically, the person the check is being paid to is the person that should sign the endorsement area.

Be aware that when a check is made out to multiple payees, or multiple parties, look to the pay-to line to determine if one, or both payees needs to endorse the check. If “or” is used, just one payee needs to endorse the check. If “and” is used, both payees must endorse the check.

3. Sign in the endorsement area as required

Once you locate the endorsement area, you can sign your name on one of the lines if it is a blank endorsement. Alternatively, you can write down the additional text if it is a special endorsement, restrictive endorsement, or other unique situation as discussed earlier.

Endorsing checks FAQs (Frequently Asked Questions)

We have put together some frequently asked questions regarding endorsing the check. Hopefully, they will clarify any doubts you might have. Take a look:

1. How do you endorse a check into someone else’s account?

You can endorse check into someone else’s account by writing the words, “Pay to the order of” followed by the person’s name. Remember to put your signature within the endorsement area.

2. How do I deposit a check made out to someone else?

The first step to endorse a check to someone else is to contact your bank and enquire if they allow a special endorsement or 3rd party check. Some banks might allow depositing a check made out to someone else, while others might not.

If your bank or credit union permits it, you can have the owner of the check sign it over to you. Your bank might require the payee to write the words, “Pay to the order of,” followed by your first and last name below their signature in the endorsement area. You can take this endorsed check to your bank or an ATM for processing. Some banks might require the payee to be present when you deposit the check.

If that doesn’t work, alternatively, you could ask the person to use their mobile app to deposit the check into their account, then transfer the funds to you.

3. How to endorse a check for deposit?

Endorsing a check for deposit is done by writing the words, “For deposit only to account number” followed by the account number you want to receive the deposit. Remember to sign your name below and make sure that everything you write is within the endorsement area.

4. Can you deposit a check that is not in your name?

Yes, you can deposit a check that is not in your name.

Most banks and financial institutions will allow you to deposit a check that is not in your name. However, some banks might refuse. That’s why we recommend contacting your bank or credit union to confirm first. This can help prevent the check from being voided if your bank doesn’t allow deposits like this one. You might be required to present some form of ID from the person signing over the check.

5. Can I deposit a check with my business name on it?

Yes, you can deposit a check with your business name on it into your business account. You can do this by ensuring that the check has your business name written on it and not your name. Next, you endorse the check as usual and then deposit it at your bank, ATM, or using an app.

It is highly recommended to keep your personal and business bank accounts separate to avoid tax complications in future.

6. Can I deposit my daughter’s check into my account?

Yes, you can deposit your child’s check into your account.

To do so, you will need to print their name on the back of the check followed by a hyphen and the word “minor”. Next, you’ll need to print your name below your child’s along with your relationship with them. In this case, it would be “parent”. Additional details like your account number will also be required.

Concluding thoughts

We get it, nothing quite beats the convenience of cashless transactions and digital wallets. However, a major chunk of the American population still uses checks. That accounts for 42% of millennials who report to have used checks for various reasons.

Whether we like it or not, checks will continue to be in circulation for several reasons. It makes sense to know how to endorse a check and how to endorse a check to someone else.

At Net Pay Advance, we specialize in delivering payday advance loans for when you’re between paychecks. Our team works relentlessly to bring you useful and relevant content so that you don’t have to go digging for information. Be it figuring out how cash advance loans online work or staying informed on topics like finances, credit, and entertainment, our personal finance blog “Our Two Cents” is here for you!