Organizing your bills is time-consuming. Why it doesn’t have to be.

Here’s a hunch: In the next three months, you will spend more money than you have at any other point in the year.

Here’s another hunch: You’re not quite as organized as you’d like to be to handle more bills, bank statements, and the other financial documents you’re set to receive in the coming months.

We’re heading into a time of year where, if spending habits tell us anything, you’re going to spend quite a bit of money. With that in mind, establishing an organization system for your financial documents, this time of year especially, is a must for maintaining financial responsibility. Keeping an organization system for your bills can be as essential as having a budget. Mishandling financial statements or bills can cost you.

So what does it mean to organize your bills and other financial documents? No, this doesn’t mean alphabetized, color-coded folders with an extensively designed ordering system. If you’re like us, you like things simple. What’s important is that you have a system that allows you fast access to your documents when you need them.

Like most projects, the hardest task is often getting started. Organizing your financial documents is no different. Something to remember: Rome wasn’t built in a day. Crafting the perfect organization system for your financial records will take time and will get better as you learn what works for you.

How to organize your financial documents for the first time

If you’re staring at a large pile of financial documents, you’re in luck. To get started, you’ll want to compile all your important documents and records, plus any bills and statements, into one centralized location.

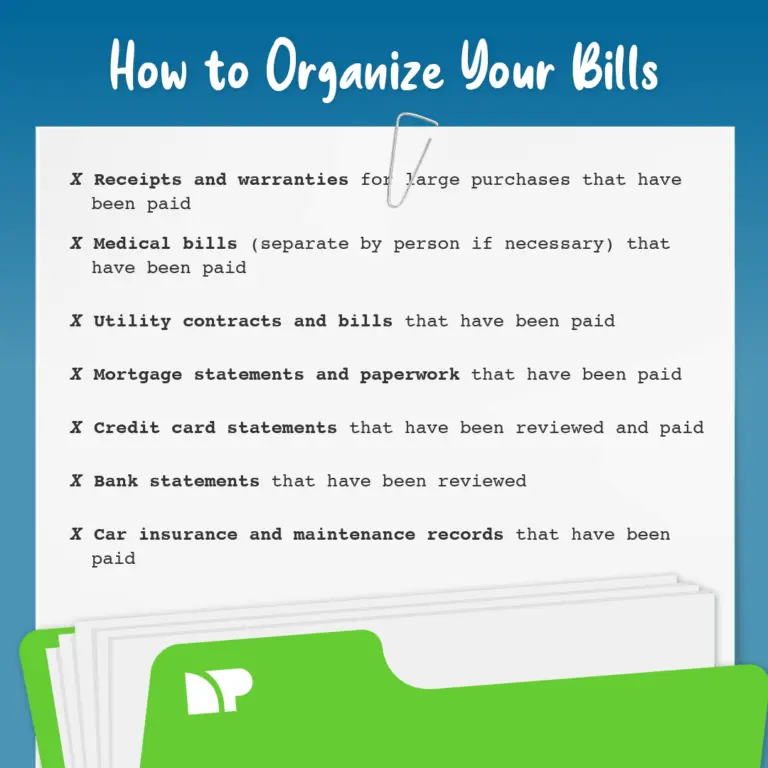

Our focus is to keep this easy. Staring at a pile of documents no longer seems easy. To make the process seem less daunting, consider separating the pile into clusters. All of your car documents? That’s a cluster. Your utility bills? Another cluster. Breaking down the pile in a series of clusters can make the process a lot more manageable.

Some clusters may be better established than others. If that’s the case for you, take that established cluster and put those documents into a folder and get it out of the way. Taking steps like clustering and attacking this process in a series of days, weeks, or months can make this task easier to work through.

Digitize. Digitize. Digitize.

What was once a pile is now a series of smaller piles, with the occasional folder scattered in. That’s progress. The reality is that the more work you put into organizing your financial documents, the better equipped for financial success you’ll be. If you have some spare time at home — we all kind of do nowadays — and you’re looking to take on a productive project, consider digitizing your financial documents.

Scanning documents can be a nuisance. Sometimes, it’s time-consuming and frustrating — reasons many of us never get around to it. Worried you don’t have the right equipment? There are solutions beyond a multi-function printer that will do the trick. Because let’s be honest, if you’re in your 20s or 30s, you don’t own a printer. If you do, it’s likely out of ink, out of paper, and has connectivity issues. And you threw out the owner’s manual in 2010.

Whether your goal is to go entirely paperless or just have backup copies stored online, you will need to get your documents copied, scanned, and uploaded. To put it more succinctly, there is some work to do up front. Digitizing your documents can pay dividends.

Your phone is your friend

Where are we? Oh, that’s right — the digital age.

Unsure as to how you might digitize your files? The answer to your problems is likely sitting in the palm of your hand. There are plenty of mobile apps you may download to scan your documents and easily convert them to PDFs. A downside may be that these applications can only process a single page at a time. This may not be the most efficient option for getting started. It is likely a better solution for adding files on an ongoing basis.

Before embarking on an upload frenzy, review the application’s privacy policy. You may consider paying up for a trusted name application, specially equipped with security tools, that way you can maintain peace of mind when uploading identity-related documents.

Get some help

OK, that last one probably took some time. There’s a chance you might get hung up there for a few days or even weeks. That’s perfectly OK. But you might want to get some help.

For starters, opt-in to paperless billing for your utilities, phone bill, and credit cards. In some cases, you may receive a discount for opting in. This will ensure that going forward you have PDFs already accessible to you so you can quickly file them where they need to go. You may also ask your bank for paperless statements. If you used an online service to file your state and federal taxes, like TurboTax, you can quickly download a PDF of your annual tax filings. In some cases, you may be able to request past statements so that you’re not scanning and importing duplicate documents.

Folders, man!

You have your documents. Now you need somewhere to house them. This is where the process can get fun because you can craft your organization system however you like. If you’re organizing for a family, you may consider organizing the files by individual. Perhaps it’s just you. Then you might consider organizing based on assets, such as your house, your car, etc., plus your financial records like bills, bank statements, etc.

Here’s what my folder structure looks like. Feel free to steal this and use it for yourself.

- Personal documents

- Assets

- Car

- 401k

- Financial

- Bills – Active

- Bills – Paid

- Credit Card

- Chase

- Discover

- Electricity

- Medical

- Phone

- Rent

- Water

- Credit Card

- Money

- Banking

- Credit Card

- Chase

- Discover

- Investments

- Taxes

Inside every folder, files are organized by date. Specific folders house individual years, then are set to show the newest added document first. This ordering helps for fast accessibility.

And don’t forget

Technology is not fool-proof. You wouldn’t rely on a single destination for all of your hard copy personal documents, and the same holds true when you digitize. Don’t forget to have at least one back-up stored somewhere reliable, like a flash drive or external hard drive. Also consider a cloud storage solution, where there are many. Security is of the utmost importance, so pick an option that is encrypted. Google Drive and Dropbox are each encrypted and trusted industry names. Using a mix of options helps provide additional assurance that your files stay in your hands.

Roger that. Do you copy?

For your most important documents — like government documents including a birth certificate, along with other documents that would be hard to replace — always keep the originals. You might decide to shred original documents. While that strategy is A-OK for things like credit card bills, there are some things that are worth hanging onto forever.

Hanging onto physical documents is in some ways necessary. Generally, if it would be hard to replace, you probably shouldn’t shred it. While some are OK with having a full collection of their files organized and digitized, that’s not everyone — and that’s perfectly fine. Prefer to house your files the old fashioned route? There are options, like we mentioned earlier, for maintaining an organization system for your hard copies as well.

A thought or two for organizing paper records: Categories are your friend. With tangible folders, your options to adjust the organization structure on the fly isn’t as easy as with a digital filing system. Be intentional at the start to ensure you are set up for long-term success. Ensure you are equipped for the next six months of files and can maintain the simplicity of filing for the road ahead. It goes without saying: The more work you put into organizing your files now, the better equipped for financial success you’ll be. If you need the reminder, here it is: Be intentional.

Organizing your financial documents is oftentimes time-consuming. It is, however, instantly rewarding, giving you much-needed access to important financial records and keeping you paying your bills on-time. A functional organization system can also prepare you for better financial health, enabling you to easily establish or rework a budget, track expenses, and identify spending patterns.

Net Pay Advance wants to help you responsibly manage your finances. Whether you have great credit, bad credit, or no credit, we work with you to help you live your moment. We assist you with emergency loans, no hard credit check required.

We’re with you.